By PATRICK LAVERY

When last we heard from the Federal Reserve on interest rates, on June 14, the Federal Open Market Committee agreed not to raise the target range for the federal funds rate for the first time in more than a year.

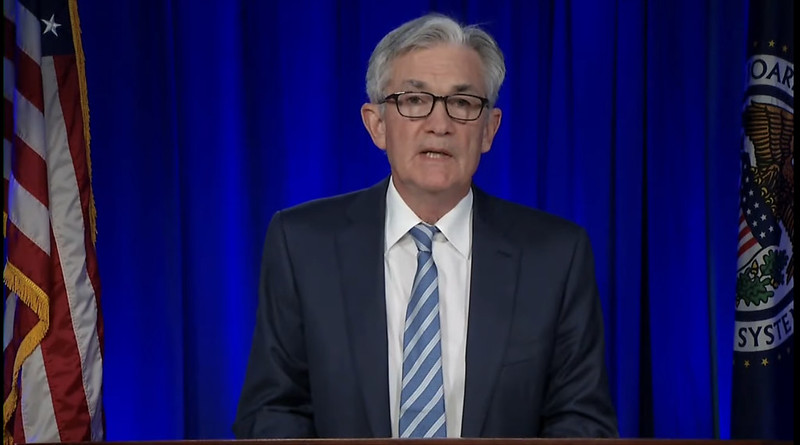

With the Fed’s next meeting now less than a week away, could Chairman Jerome Powell be preparing to announce one of the hikes that he said in June might still be remaining for this year? Or will the FOMC stick to a holding pattern?

And how are those developments going to impact a U.S. housing market that Powell has continuously characterized as sluggish throughout 2023?

It is predicted that the central bank will deliver a quarter of a percentage point rate increase next week as they continue to try and battle inflation.

That could impact the housing market in the second half of 2023. A Yahoo! Finance article published around the time of the June FOMC meeting reminded consumers that as interest rates rise, home prices are likely to fall – as happened between June 2022 and January 2023.

But some industry leaders watching this year’s market say buyers waiting on the sidelines for home prices to drop may be out of luck for some time because of the ongoing supply crisis. Mike Simonsen, founder and president of Altos Research, said last week that because 2023 will end with less inventory than 2022, 2024 already has positive signals for home price gains.

And the Fed’s latest survey of its Federal Reserve Banks by district, known as the Beige Book, says higher interest rates have not deterred as many buyers as some would think.

“Despite higher mortgage rates, demand for residential real estate remained steady, although sales were constrained by low inventories,” the Beige Book summary said.

Do interest rates need to go up?

In an initial reaction to last month’s pause on rate hikes, Chief Economist Lawrence Yun of the National Association of Realtors said there is no need to consider raising interest rates further.

“In fact, considering the balance sheet difficulties faced by community banks and the weakness in the commercial real estate sector, the Fed should look at cutting interest rates before the end of the year,” Yun said in a statement.

Yun explained that a monetary policy lag time exists between decision and inflation.

“The rate hikes from earlier months have yet to exert their force at a time when inflation has already decelerated to 4%,” he said. “The Fed should look forward, not backward.”

Homebuyers won’t see a meaningful drop in their rates until officials commit to ending rate hikes, according to leaders at Fannie Mae.

Doug Duncan, senior vice president and chief economist, said that they expect the Federal Reserve will stick to a ‘higher-for-longer’ policy after one or two more quarter-point increases and until they conclude that the core inflation rate is sustainably at their 2% target.

“Putting aside any temporary volatility, we expect mortgage rates to stay higher as well,” Duncan said.

Mortgage rates retreated last week, dropping more than ten basis points in a one-week period.

Officials at Freddie Mac reported Thursday that the 30-year fixed-rate mortgage averaged 6.78%, down from 6.96% the week prior. A year ago at this time, the 30-year FRM averaged 5.54%.

The 15-year fixed-rate mortgage reversed course as well, down from 6.30% to 6.06%. A year ago, it averaged 4.75%.

A press conference will be held on Wednesday after the FOMC meeting.

Read More Articles:

Rates Drop By 10+ BPS As Prices Surge

Refis See Improvement, But Purchase Activity Remains Constrained