By PATRICK LAVERY

The Federal Open Market Committee called a pause on their rate hikes Wednesday, electing to keep the target range for the federal funds rate unchanged at 5% to 5.25% while continuing to significantly reduce securities holdings.

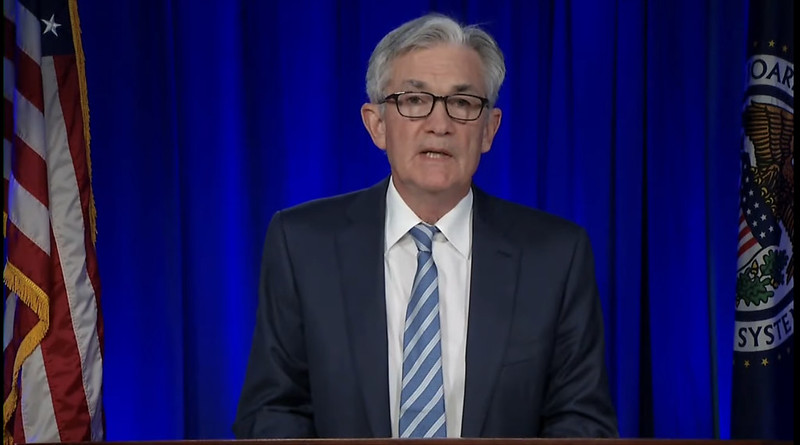

It was not a complete victory lap for Federal Reserve Chairman Jerome Powell, who told reporters at a press conference that the FOMC overwhelmingly expects to raise interest rates “somewhat further” before the end of 2023.

The reason for the future uncertainty in interest rates continues to be inflation, which is still “well above” the Fed’s longer-run 2% goal, according to Powell. The Summary of Economic Projections released concurrently with Wednesday’s announcement kept that 2% target destined for 2025.

A survey of participants in the SEP set the median expected federal funds rate at 5.6% at the end of 2023, 4.6% at the end of 2024, and 3.4% at the end of 2025.

However, Powell said Wednesday’s decision was arrived at “in light of how far we have come in tightening policy, the uncertain lags with which monetary policy affects the economy, and (with) potential headwinds from credit tightening.”

Although the chairman indicated a pickup in the growth of consumer spending, he said housing sector activity remains weak likely because of higher mortgage rates, as has been the case in nearly every Fed update so far in 2023.

Total Personal Consumption Expenditure prices rose 4.4% for the 12 months ending in April and core PCE prices were up 4.7%, slightly above the rates of the 12-month period ending in March that were disseminated after the last Fed meeting.

“We have been seeing the effects of our policy tightening on demand in the most interest-rate-sensitive sectors of the economy, especially housing and investment,” Powell said in prepared remarks. “It will take time, however, for the full effects of monetary restraint to be realized, especially on inflation.”

As it did at the time of the May meeting, the FOMC in its Implementation Note on Wednesday directed the Open Market Desk at the Federal Reserve Bank of New York to continue reinvesting into agency mortgage-backed securities the amount of principal payments from Fed holdings of agency debt and MBS received in each calendar month that exceeds a $35 billion cap.

Read the summary of economic projections

The US unemployment rate ticked up to a still-low 3.7% in May, but the projections see that figure rising back above 4% by the end of this year, and up to 4.5% by the end of 2024. Nominal wage growth has begun to ease, Powell indicated, and job vacancies have declined over the first half of 2023.

For those whose wallets have been stretched the most in the last year-plus, Powell said price stability remains the Fed’s top priority.

“Without price stability, the economy doesn’t work for anyone,” he said. “In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.”

Chief Economist Lawrence Yun of the National Association of Realtors reacted to the news by indicating it may be time for the Feds to reverse course.

“A monetary policy lag time exists between decision and inflation. The rate hikes from earlier months have yet to exert their force at a time when inflation has already decelerated to 4%. There is no need to consider raising interest rates. In fact, considering the balance sheet difficulties faced by community banks and weakness in the commercial real estate sector, the Fed should look at cutting interest rates before the end of the year. The Fed should look forward, not backward,” Yun said in a statement.

The FOMC next meets July 25-26.

Read More Articles:

What Will It Take To Get Millennials In Homes?

Forecasting The Future: When Will People Start Moving Again?