The average mortgage rate ticked down again this week, but waning banking sector concerns have rates seesawing.

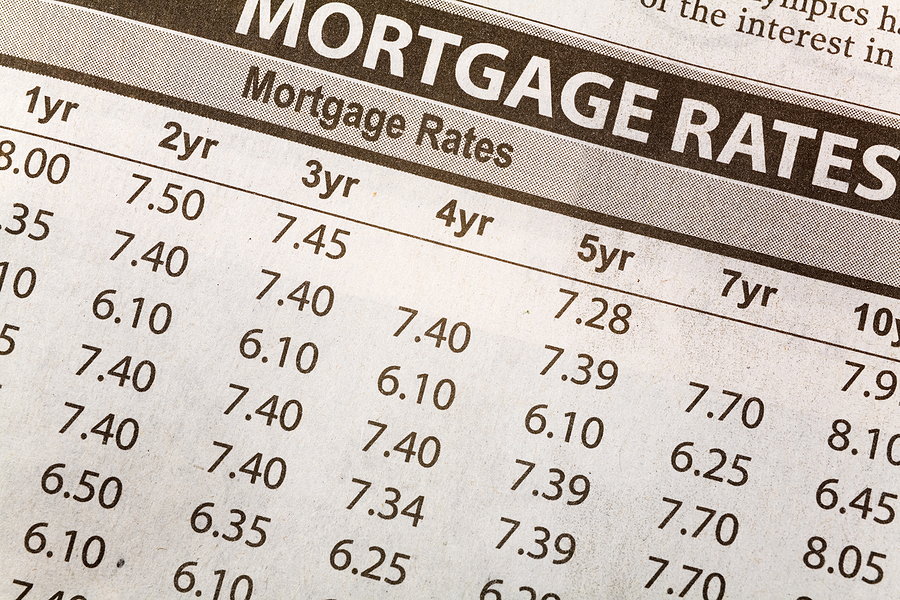

Officials at Freddie Mac reported Thursday that the 30-year fixed-rate mortgage averaged 6.32%, down from 6.42% the week prior.

A year ago at this time, the 30-year FRM averaged 4.67%.

The 15-year fixed-rate mortgage dipped from 5.68% to 5.56%. A year ago, it averaged 3.83%.

“Economic uncertainty continues to bring mortgage rates down,” said Sam Khater, Freddie Mac’s Chief Economist.

“Over the last several weeks, declining rates have brought borrowers back to the market but, as the spring homebuying season gets underway, low inventory remains a key challenge for prospective buyers.”

Some buyers returned to the market early in order to snag a sub-7% interest rate and falling home prices. Existing home sales were up in February while new home sales increased, though less than expected.

While both Freddie Mac and the Mortgage Bankers Association reported average rates falling further, MortgageNewsDaily’s Rate Index is up 0.15% for the week as of Thursday.

Zillow Senior Economist Orphe Divounguy explained that rates have been sensitive to recent bank failures that set the economy on edge, but are rising again as fallout appears to be limited.

“Those fears seem to be moderating and a number of leading indicators suggest the US economy is still on solid footing. That means inflation may still be slow to come down, leaving the door open for more Fed policy tightening and causing rates to remain elevated,” he wrote.

“But economic forecasts differ – tighter financial conditions and a resulting cooling of the US economy would have the opposite effect.”

Fannie Mae recently suggested that the Silicon Valley Bank collapse and its fallout could tip the nation into recession, saying bank failures often precipitate economic downturns.

New economic data showing increasing inflation could lead to another round of rate hikes from the Central Bank, which will next meet on May 3. Analysts say Wall Street is split on rate increase predictions, with some expecting another quarter-point hike and others expecting none at all.

Follow Us On Twitter:

Industry leaders are rallying around a federal bill that would permit the nationwide use of remote online notarization. https://t.co/vcX9Bs5dDP

— The Mortgage Note (@TheMortgageNote) March 30, 2023

Read More Articles:

Fidelity National Financial Penalized $3.5M For Alleged ‘No-Poach’ Agreements

UWM Successes Subject Of Supplemental Complaint In Ultimatum Suit