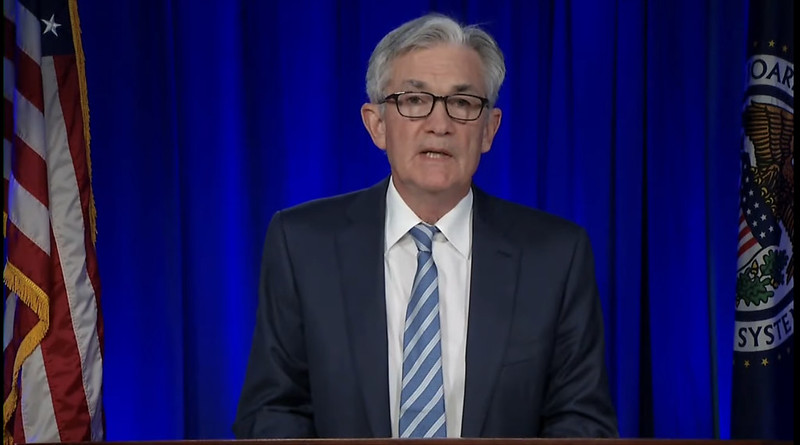

In a speech at the annual Jackson Hole symposium, Federal Reserve Chairman Jerome Powell said the central bank is likely to begin withdrawing some of its pandemic policies before the end of the year. Still, interest-rate increases won’t be coming overnight.

That means the Fed will likely begin cutting the amount of bonds it buys each month before the end of the year. But Powell stressed that these cuts should not be seen as indicators that rate increases are around the corner.

“The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test,” he said.

He added that while inflation is solidly around the Fed’s 2% target rate, “we have much ground to cover to reach maximum employment,” which is the second prong of the central bank’s dual mandate and necessary before rate hikes happen.

The Federal Reserve slashed its benchmark interest rates to near zero last year and accelerated its bond buying to combat the pandemic’s economic impact. The economy began to recover earlier this year, but the Fed announced in April it would keep its pandemic policies in place as unemployment remained high.

But some are skeptical that keeping interest rates low is best for the economy. Chief investment officer at Bleakley Advisory Group and CNBC correspondent Peter Boockvar warned yesterday that the Fed’s policies have created a house pricing bubble that could decimate the equity of those who bought homes over the past year and have far-reaching impact.

Boockvar singled out those who put down 5% amid historically low mortgage rates, saying they could be in trouble if home prices correct by 10 percent. This would especially impact first-time homebuyers.

“Their equity is basically wiped out,” he said. “For those who have owned for a while that have built up equity, they will be much more insulated,” he told CNBC.

Boockvar has been consistently critical of the Fed’s policies. He has been on inflation watch since mid-2020 and argued that Powell’s monetary policy is “impotent in its ability to stimulate economic activity,” saying in June that it was high time Powell began tapering interest rates.

But with no official date set for interest hikes, they could remain low into 2022 if the Delta variant worsens.

“The song remains the same,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said. “We still think it’s reasonable to expect the tapering announcement in November, but it could easily be delayed if the post-Delta rebound takes longer than we expect.”