Seriously delinquent mortgages dropped by more than half year-over-year (YOY) at seven national banks, according to a report from the Office of the Comptroller of the Currency.

Though the findings are optimistic, the banks in the study– Bank of America, Citibank, HSBC, JPMorgan Chase, PNC, U.S. Bank, and Wells Fargo– were handling almost 1,900 fewer loans YOY, complicating the final picture.

Overall, the banks serviced about 12.5 million first-lien residential mortgage loans, totaling $2.59 trillion in unpaid principal balances. This is 23% of all U.S. residential mortgage debt. In Q3 2020, $2.866 trillion or 14,393 loans.

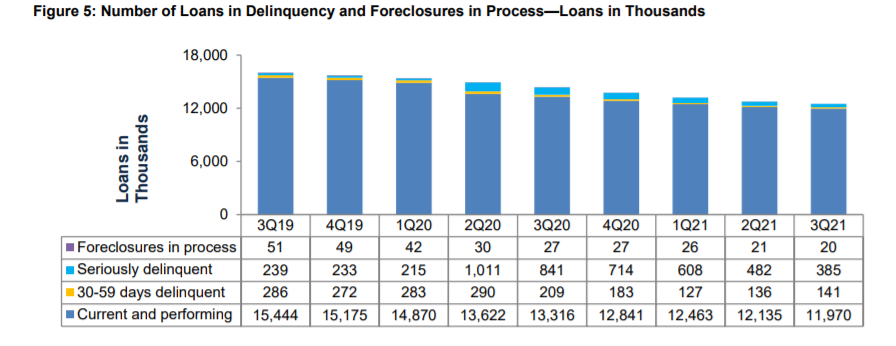

The share of mortgages that were current at the end of Q3 2021 was 95.6%, up from 92.5% in Q3 2020.

The seven banks had a total of 385,000 mortgages in serious delinquency, or mortgages for which payments were late by 60 or more days. Serious delinquencies spiked in Q2 but have been declining. Serious delinquencies accounted for 482,000 mortgages in Q2 2021 and 841,000 in Q3 2020.

Foreclosure activity was up in Q3, with 925 new foreclosure starts. That is an increase of 150.7% YOY and 56.3% from Q2. However, the number of foreclosures in process dropped slightly from Q2. Completed foreclosure sales, short sales, and deed-in-lieu-of-foreclosure actions rose 42.7% YOY.

The report notes that policies related to the pandemic, such as foreclosure moratoriums, have “significantly affected” these numbers.

Foreclosures are being closely watched by the industry as foreclosure moratoriums expire. Default notices, scheduled auctions, and bank repossessions are down 5% from a month ago but up 94% from a year ago, according to ATTOM’s November 2021 U.S. Foreclosure Market Report. This is the seventh consecutive month of annual increases.

“After an initial surge following the end of the government’s moratorium, it appears that foreclosure activity may be slowing down as we move towards the end of the year,” said Rick Sharga, executive vice president of RealtyTrac, an ATTOM company.

“Despite concerns about a pandemic-driven wave of defaults, mortgage delinquency rates, and foreclosure starts have continued to decline due to government and industry programs, and a recovering U.S. economy.”

However, new forbearance plan starts increased 24% over the past four weeks, including a jump of nearly 8,000 the week before Thanksgiving.

They are primarily driven by FHA/VA loans, which saw a more than 40% spike, but GSE loans also increased by 29%. Black Knight is “watching this trend closely.”