By PATRICK LAVERY

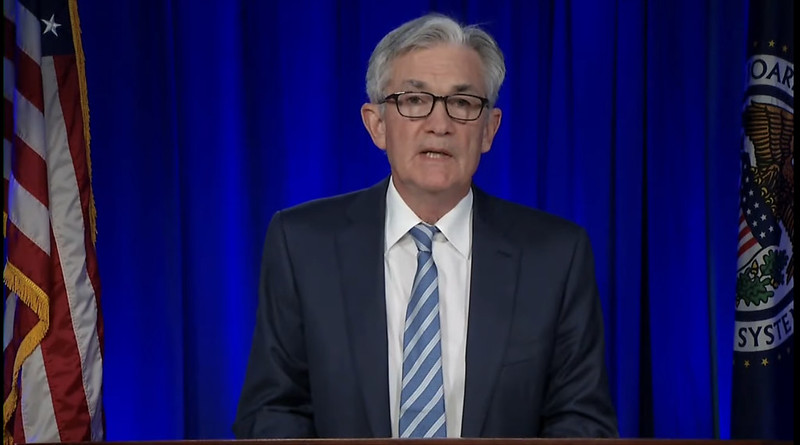

Saying he and the Federal Open Market Committee were “proceeding carefully,” Federal Reserve Board Chairman Jerome Powell announced that they voted unanimously Wednesday to leave its policy interest rate unchanged for a third straight meeting.

This ensures that after more than a year of incremental hikes that eventually saw the key rate spike 5 1/4 percentage points dating back to the beginning of 2022, the target range will, for now, remain at 5.25% to 5.5%.

Most experts do not expect the FOMC to start bringing the rate back down again until the third quarter of 2024, owing that to Powell and the Fed’s continuing mandate to bring inflation down to 2%.

Total Personal Consumption Expenditures prices rose 2.6% over the 12 months ending in November, while core PCE prices excluding the food and energy sectors climbed 3.1%, although both figures beat September projections according to the FOMC’s Summary of Economic Projections also released Wednesday.

Powell said the Fed still is not forecasting inflation to fall to 2% until 2026.

“The lower inflation readings over the past several months are welcome, but we will need to see further evidence to build confidence that inflation is moving down sustainably toward our goal,” Powell said in prepared remarks delivered to reporters Wednesday afternoon. “Longer-term inflation expectations appear to remain well anchored, as reflected in a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets.”

As he did at the Nov. 1 press conference following the last FOMC meeting, Powell noted that activity in the housing sector has flattened after picking up during the summer of 2023, with rising mortgage rates to blame, although those rates, no doubt buoyed by Wednesday’s continued freeze, are now closer to 7% across the board than their previous recent high of about 8%.

Powell said he and his colleagues are “acutely aware” that inflation at high levels erodes purchasing power for commodities such as housing, but stressed that we continue to live in uncertain times and that regardless of recent trends, things can change on a dime.

“While we believe that our policy rate is likely at or near its peak for this tightening cycle, the economy has surprised forecasters in many ways since the pandemic, and ongoing progress toward our 2% inflation objective is not assured,” he said.

At the same time, Powell told reporters that they expect to see rates drop to 4.6% by the end of 2024.

Once again in its Implementation Note accompanying the close of this week’s meeting, the FOMC directed the Open Market Desk at the Federal Bank of New York to reinvest into agency mortgage-backed securities the amount of principal payments from Fed holdings of agency debt and agency MBS received each month exceeding a cap of $35 billion.

Read More Articles:

Projections For Monetary Policy Show No Rate Changes

Rocket Now Shows You Nearby Homes For Sale On Apple CarPlay

Wells Fargo Contribution To Help Train Veterans For Careers In Construction

Sign up for our free newsletter.