Gross domestic product declined for a second quarter, down 0.2% on the heels of Q1’s 0.4% dip, the Commerce Department said.

By a common definition, this means that the U.S. has entered into a recession.

The National Bureau of Economics, a non-profit that determines when the U.S. is officially in recession, defines it as a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Many economists say they don’t believe the economy has fully entered recession, pointing out that falling GDP is only one measure of many. Fed chairman Jerome Powell said the data should be taken with “a grain of salt.”

But formal definitions notwithstanding, a majority of Americans believe the economy is in recession.

An IBD/TIPP poll found that 58% of Americans think the country is currently in a recession, with 54% of respondents saying their wages have not kept pace with inflation.

Another poll found that 70% of Americans believe that a recession is coming, if not already here.

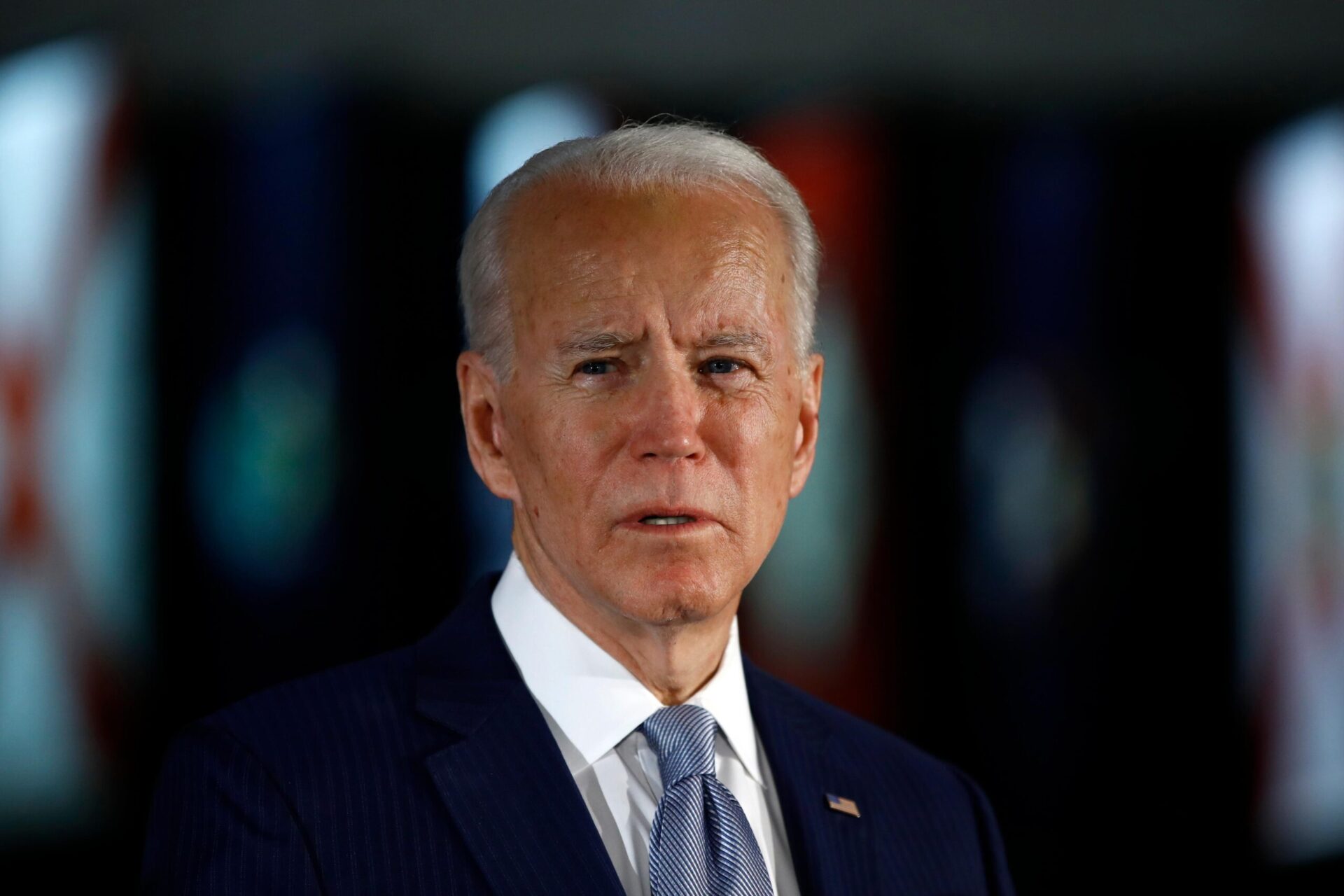

The White House is struggling to keep recession fears under control. President Biden this week said he doesn’t expect a recession and that the country is not currently in one.

“God willing, I don’t think we’re going to see a recession,” he said.

Republican lawmakers have accused him of redefining recession to make the economy look healthier than it is.

Analysts expect a recession to cool sky-high home prices significantly, though some say a full house-price correction won’t happen.

Michael Fratantoni, chief economist and senior vice president of research and industry technology at the Mortgage Bankers Association, told NBC to expect a flip from a seller’s market to a buyer’s market, but not a crash.

“What that means on the ground is that for a home seller, they’re going to have less negotiating power, and a home buyer will have more,” he said. “But really, we’re just returning to a more typical market than an extremely overheated market.”

The housing market is historically tied up in inflation fights that lead to recession.

“The most frequent way we enter into recession is the Fed raises rates to fight inflation. The leading indicator for this type of recession is housing,” Bill McBride, author of the economics blog Calculated Risk, told Fortune.

“It [housing] is not the target, but it [housing] is essentially the target.”