The Federal Housing Finance Agency announced it is dropping the COVID-era Adverse Market Refinance Fee beginning August 1. But what does that mean for borrowers who were already in the process of refinancing loans?

That depends on the lender.

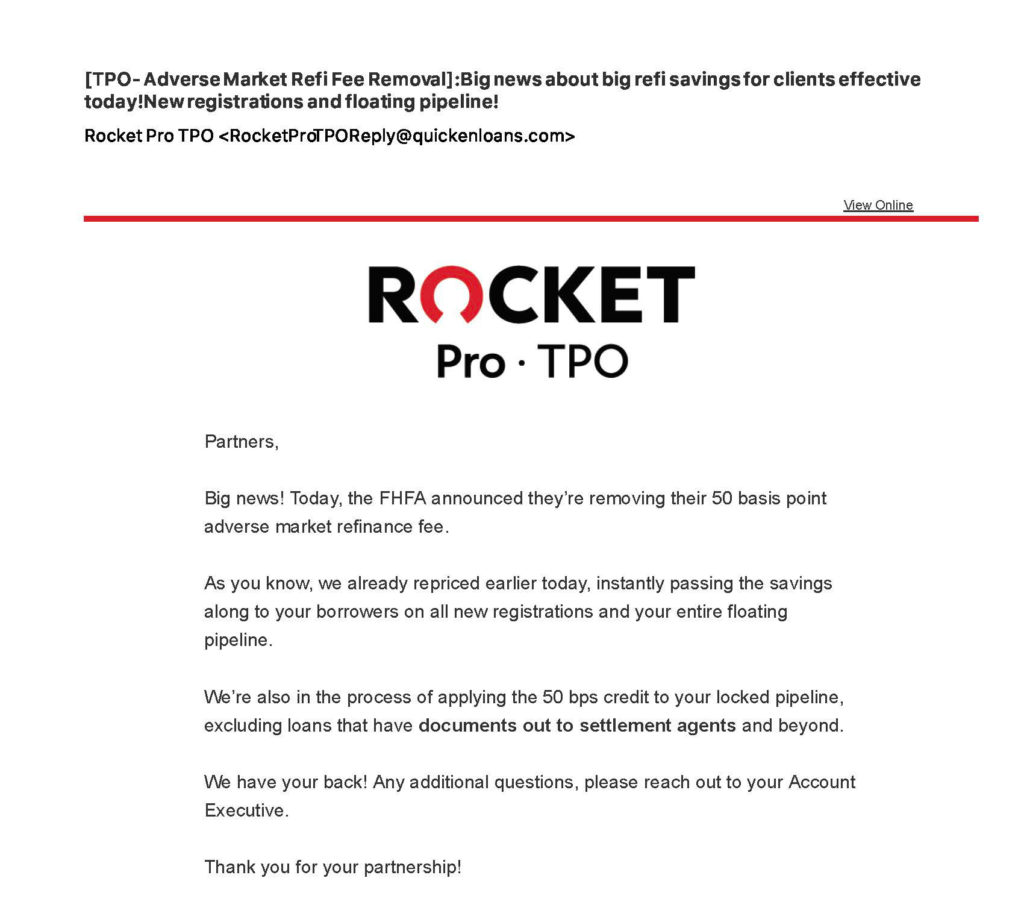

Rocket Mortgage notified brokers last week that it is dropping the fee immediately for loans in progress. Others haven’t publicly committed to removing the fee – or did not respond to Mortgage Note requests for comment.

“As you know, we already repriced earlier today, instantly passing the savings along to your borrowers on all new registrations and your entire floating pipeline,” Rocket said in an email to brokers. “We’re also in the process of applying the 50 bps credit to your locked pipeline, excluding loans that have documents out to settlement agents and beyond.”

The Mortgage Note reached out to Rocket Mortgage, UWM, loanDepot, Caliber, and Freedom Mortgage to ask their plans for the fee. Only Rocket confirmed it is dropping the fee for loans in progress.

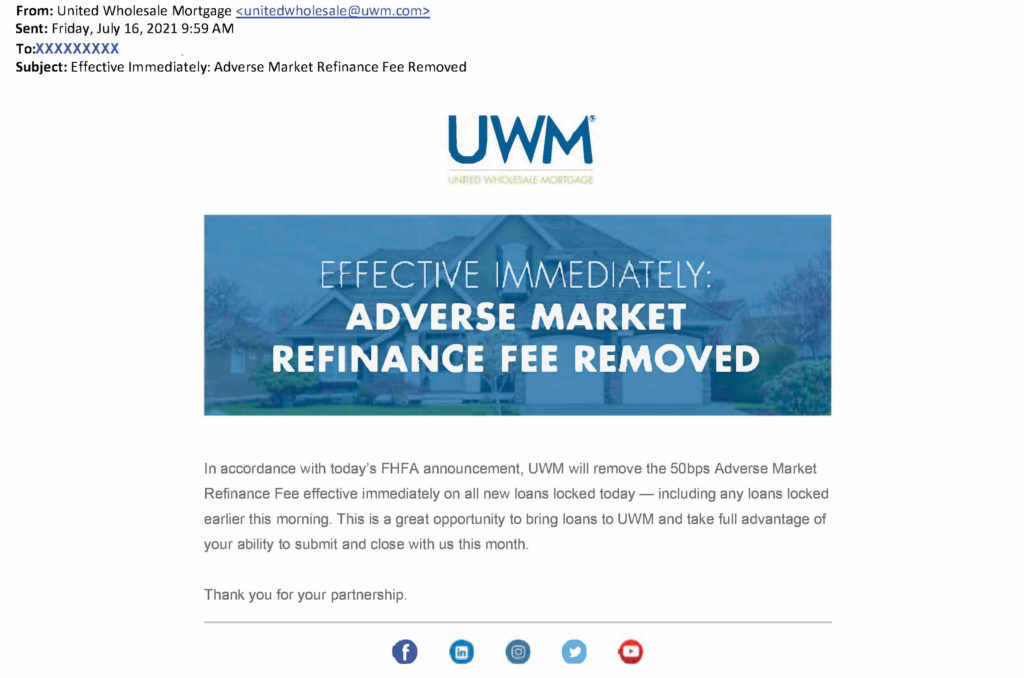

UWM notified brokers it is removing the fee going forward, according to a copy of an email obtained by The Mortgage Note.

“In accordance with today’s FHFA announcement, UWM will remove the 50bps Adverse Market Refinance Fee effective immediately on all new loans locked today – including any loans locked earlier this morning,” UWM wrote. “This is a great opportunity to bring loans to UWM and take full advantage of your ability to submit and close with us this month.”

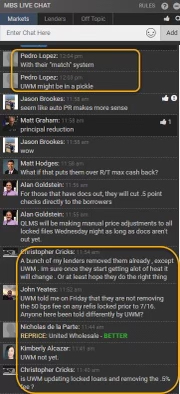

In an industry chat room, brokers discussed the differing approaches.

“A bunch of lenders removed them already, except UWM,” one commenter said. “I’m sure once they start getting a lot of heat it will change. Or at least hope they do the right thing.”

Another added, “UWM told me on Friday that they are not removing the 50 bps fee on any refis locked prior to 7/16. Anyone here been told differently by UWM?”

Not giving back the fee could mean borrowers pay .5 percent more on refinances than they need to with profits, presumably, sticking with the lender as the government would no longer expect or collect that revenue. That could total hundreds of loans in UWM – and other companies’ – pipelines whose customers could be charged more than prevailing rates, according to industry insiders.

Earlier this year, Consumers for a Sound Economy warned about the potential for increased costs and fees passed on to brokers and consumers when UWM issued its ultimatum to some 15,000 brokers across the country, forcing them to choose between UWM and two of its biggest competitors, Rocket Mortgage and Fairway Independent.