By ERIN FLYNN JAY

Foreclosure numbers are up by double-digit numbers and industry leaders say they will continue to rise this year.

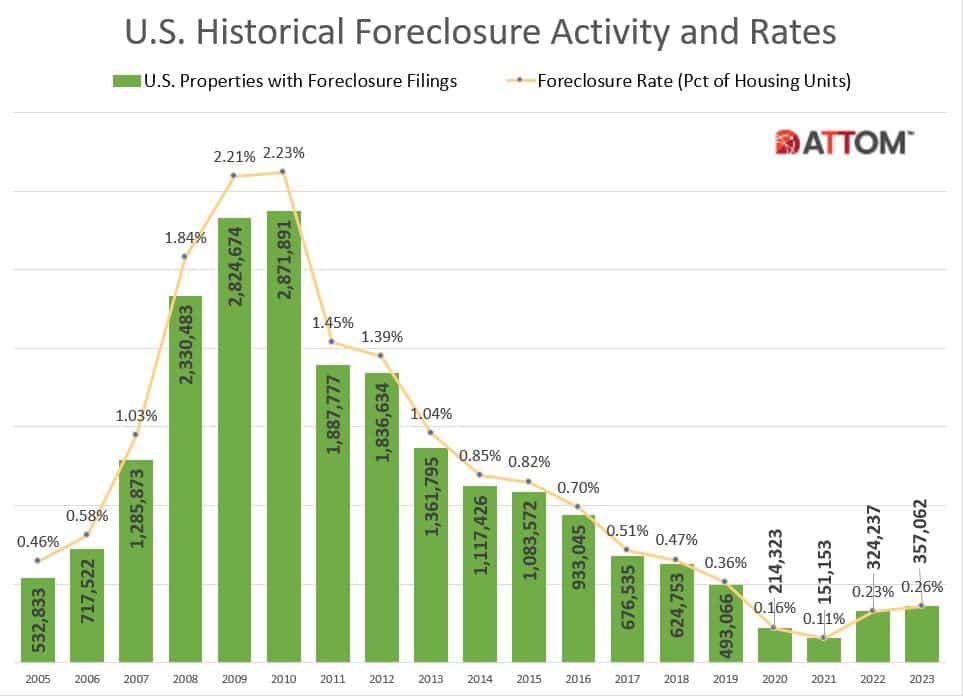

Earlier this month, ATTOM, a curator of land, property, and real estate data, released its Year-End 2023 U.S. Foreclosure Market Report, which shows foreclosure filings — default notices, scheduled auctions, and bank repossessions — were reported on 357,062 U.S. properties in 2023, up 10% from 2022 and 136% from 2021.

CEO Rob Barber told The Mortgage Note several elements may be contributing to the rise in foreclosures.

“Key among them is the increase in interest rates, especially for adjustable-rate mortgages, leading to higher monthly payments for homeowners. Additionally, escalating unemployment rates are a concern,” Barber said.

Barber said many homeowners were hanging on to their homes because of the forbearance program put into place to respond to the Covid pandemic.

“The subsequent lifting of this program in 2023 has been a significant driver in the surge of foreclosure filings, as homeowners grapple with resuming their regular mortgage payments,” Barber said.

Donna Schmidt is the managing director and founder of DLS Servicing, a provider of default servicing consulting services, training, and technology for mortgage servicers. She said borrowers were able to request a forbearance until May 31, 2023.

“This protected against a foreclosure commencement at least through the expiration of the forbearance, thereby keeping foreclosure rates low in 2022. Foreclosures have increased as more borrowers exhausted forbearance protections,” Schmidt said.

The silver lining is that foreclosure filings in 2023 were down 88% from a peak of nearly 2.9 million in 2010, according to ATTOM’s data.

What states were the most impacted?

States with the highest foreclosure rates in 2023 were New Jersey (0.46% of housing units with a foreclosure filing); Illinois (0.42%); Delaware (0.41%); Maryland (0.40%); and Ohio (0.38%).

Rounding out the top 10 states with the highest foreclosure rates in 2023 were South Carolina (0.38%); Nevada (0.37%); Florida (0.37%); Connecticut (0.35%); and Indiana (0.32%).

States that saw the greatest number of foreclosure starts in 2023 included California (29,180 foreclosure starts); Texas (28,533 foreclosure starts); Florida (27,427 foreclosure starts); New York (17,330 foreclosure starts); and Illinois (13,764 foreclosure starts).

The metropolitan areas with a population greater than one million that saw the greatest number of foreclosure starts in 2023 included New York City (18,464 foreclosure starts); Chicago, Illinois (11,620 foreclosure starts); Houston, Texas (9,476 foreclosure starts); Los Angeles, California (8,835 foreclosure starts); and Philadelphia, Pennsylvania (8,224 foreclosure starts).

What does the U.S. foreclosure market look like moving forward?

ATTOM’S report may indicate a return to typical levels of foreclosure activity following the pandemic, in line with general economic trends. Foreclosure filings were down 28% from 2019.

“This information and the data trends highlighted offer valuable insights for strategic planning and decision-making in the real estate sector, especially for individuals interested in investing in or managing risks related to foreclosures,” Barber said.

Schmidt said she expects foreclosure numbers to rise again this year.

“Inflationary pressures have pushed consumer credit card debt to historically high levels, costs have increased significantly, yet median incomes have not kept pace,” noted Schmidt. “At some point, the scales will tip, and we will see increased defaults. This will naturally lead to more foreclosures. When that will occur is still not clear – but it should happen by the second half of 2024.”

Who is most at risk for foreclosing and why?

Schmidt said borrowers who default again after having previously received loss mitigation assistance, especially those who received repeated assistance, will be the first to head to foreclosure.

“These previous loss mitigation programs, in many instances, led to deferred payments or secondary liens that will eat at the equity which could have been gained by rising housing prices,” Schmidt said. “Therefore, these borrowers will not be able to sell their properties for the balances that are now due. They will need to consider short sales or will face foreclosure.”

What to do if you are in trouble.

Victoria Araj, section editor for Rocket Mortgage, said in an article posted this week that in addition to refinancing their home, owners can get help through their lenders.

“If you’re struggling to keep up with your monthly mortgage payments, acting fast can help you save your home,” Araj wrote. She advised people to talk to their lenders early on.

Officials at the U.S. Department of Housing and Urban Development also advise people to talk with their lenders as soon as they realize they have a problem. They provide housing counseling services.

Read More Articles:

Direction Of Commercial Real Estate Market Unclear, But There Is A Glimmer Of Hope

Former FHA Commissioner And MBA President Remembered For Impact On Housing Industry

Op-Ed: Congress, Please Don’t Legislate A Takeover Of The Nation’s Rental Housing Market

Listen To Our Podcast:

Sign up for our free newsletter.