The housing market in red states is white-hot compared to their blue counterparts, a new analysis finds.

As U.S. housing prices remain high and experts predict the trend will continue, states led by Republican legislatures and governors are disproportionately represented among the hottest housing markets in the country, with experts offering a variety of explanations as to why that might be.

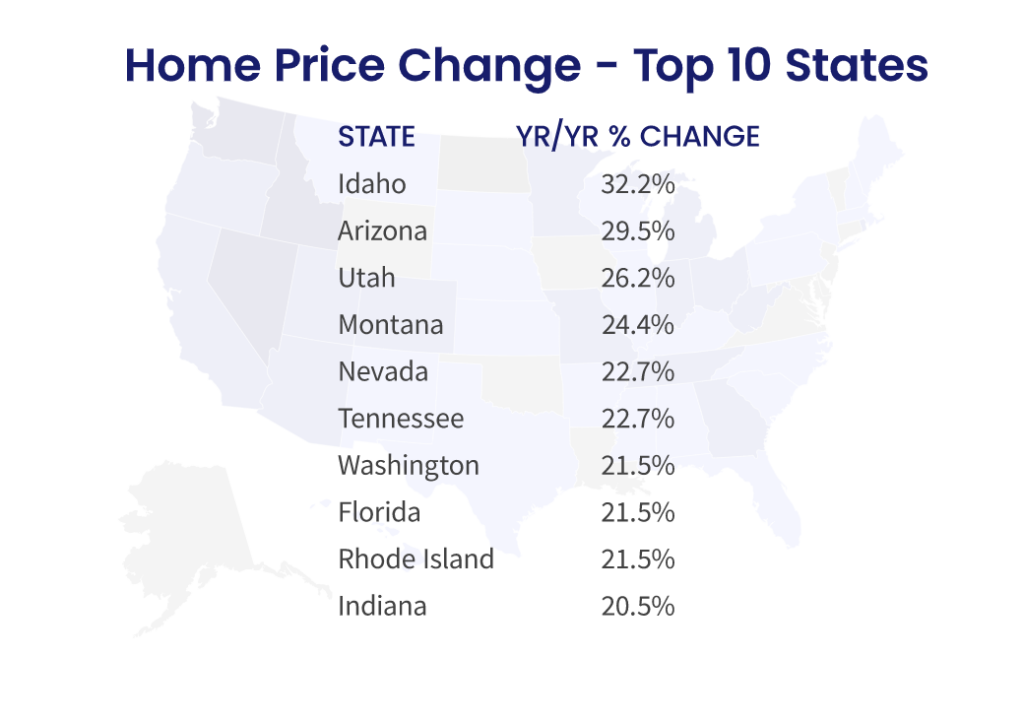

Data analyst firm CoreLogic noted this month that “home prices nationwide, including distressed sales, increased year over year by 18.1% in August 2021 compared with August 2020, marking the largest annual gain in home prices in the 45-year history of the CoreLogic Home Price Index.”

That price spike was driven by a sharply constricted housing supply that saw homebuyers scrambling to scoop up a limited number of houses nationwide. Sky-high price tags and cutthroat bidding wars became the norm as first-time buyers saw prices grow beyond their reach and even well-placed current homeowners struggled to afford new purchases and upgrades.

Yet according to CoreLogic data, red states—those in which the Republican party maintains control of either the statehouse, the governorship, or both—are disproportionately represented among the top 10 states with the highest home price increases: Among that list, only two states—Washington and Rhode Island—could be considered historically “blue.”

Solid red states such as Arizona, Florida, Idaho, Indiana, and Tennessee top the list; in one state, Utah, Republicans have controlled both chambers of the legislature as well as the governor’s chair for at least 30 years.

Experts who spoke to the Mortgage Note offered a variety of suggestions about why Republican-led states are dominating the list.

Betsey Stevenson, a public policy professor at the University of Michigan’s Ford School, suggested economic shifts during the pandemic likely played a role. “As people gained the ability to work remotely, the decision about where to work and where to live became a little less tied,” she said.

“As a result, housing markets with weaker labor markets were more attractive than they were prior to the pandemic,” she argued.

Stevenson pointed to research by the Brookings Institute suggesting Democratic-controlled districts tend to prioritize “housing affordability” among other safety-net provisions, potentially leading to less-drastic spikes in housing prices.

Robert Dietz, the senior vice president and chief economist of the National Association of Home Builders, echoed Stevenson’s suggestion that more favorable regulatory environments in red states may have played a role in their lopsided showing.

“Homebuilding has experienced a suburban shift over the course of 2020 and 2021 that resulted in demand for new construction moving to lower-density, lower-cost markets,” Dietz told TMN. “This is in part due to telecommuting and hybrid work models.”

“As a result, housing demand has increased in markets with lower regulatory costs, which often tend to be red states,” he said.

And then there’s the overall economic environment in these states. Labor Department data published in August showed the 10 states with the lowest unemployment rates are all led by GOP governors – while the 10 states with the highest percentage of out-of-work Americans are run by Democratic governors. Red states also recovered more quickly from the effects of the pandemic lockdowns than their blue counterparts.

Additional data from CoreLogic indicate the markets most likely to witness price declines in the near future are all within the solidly blue states of California, Massachusetts, and Connecticut.

Conversely, the firm’s analysis of home price hikes in metropolitan areas shows cities within blue states dominating that list: Of the top 10 largest metro increases, seven of them—including Los Angeles, Denver, Chicago, and Las Vegas—are within states solidly controlled by Democrats.

Overall, red states have tended to have more affordable housing markets than blue ones. The real estate marketing firm Reventure Consulting notes Republican-controlled states have historically seen significantly cheaper housing markets, so much so that “by the end of 2020, the typical price of a home in a blue state was $367k, while the typical price in a red state was $198k.”