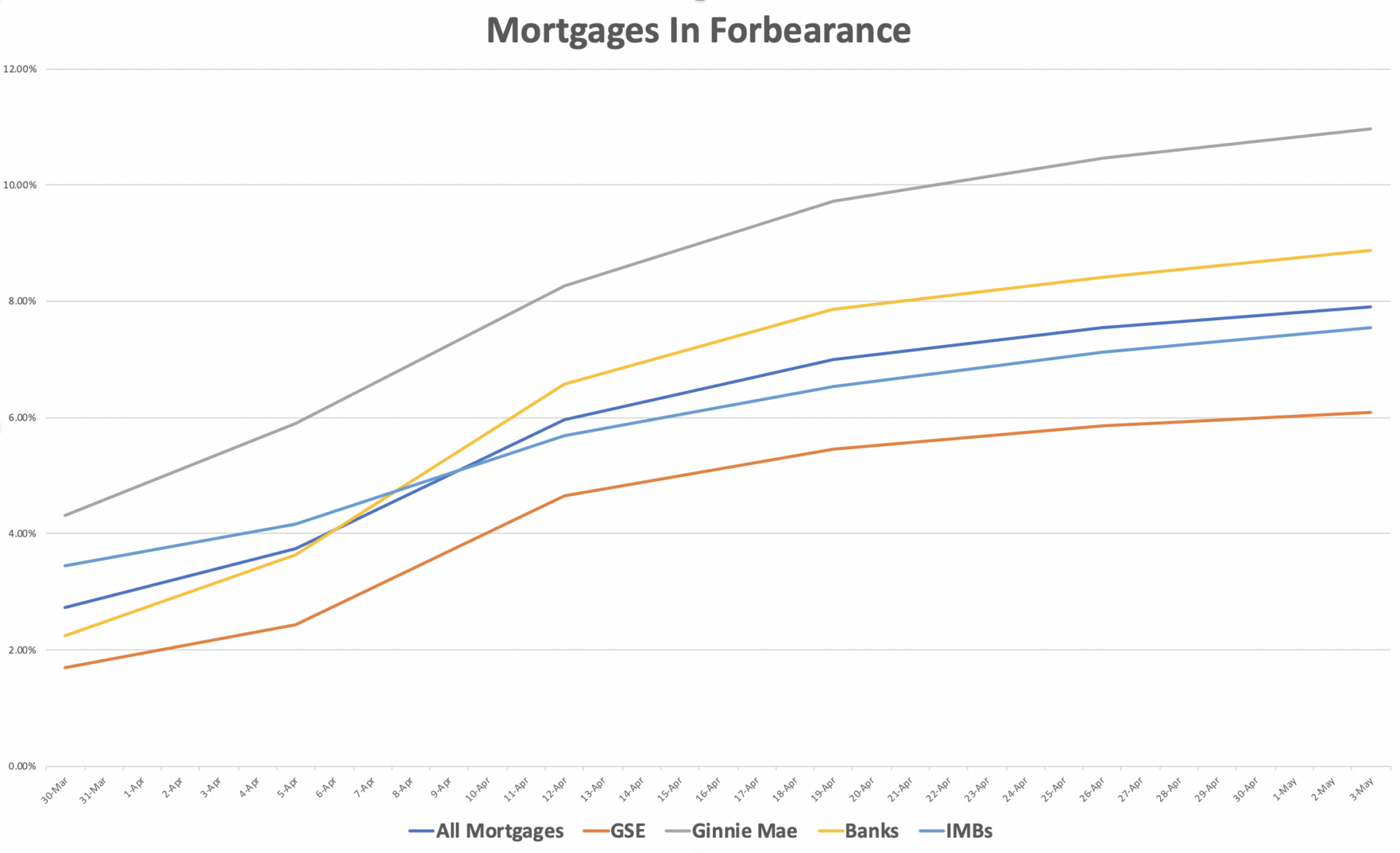

The share of mortgages in forbearance in the United States has swollen to 7.91 percent, but the rate of growth has slowed in recent weeks, according to the latest report by the Mortgage Bankers Association released Monday.

The MBA estimates that 4 million American homeowners were in forbearance plans as of May 3.

“With the calendar turning to May, the share of loans in forbearance increased, but the pace of the increase and incoming forbearance requests continued to slow,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “The dreadful April jobs report showed a decline of more than 20 million jobs, and a spike in the unemployment rate to the highest level since the Great Depression. It will not be surprising if the forbearance numbers continue to rise.”

The share of homeowners in forbearance increased by 0.37 percentage points from the week before, after a 0.55 percent increase a week earlier. That compares to a 2.21 percent increase the week ending April 12.

The survey found:

- Ginnie Mae loans in forbearance increased to 10.96 percent from 10.45 percent.

- Fannie Mae and Freddie Mac loans in forbearance increased to 6.08 from 5.85 percent.

- The share bank mortgages in forbearance grew to 8.75 percent from 8.41 percent.

- Non-bank lenders saw the number of loans in forbearance grow to 7.54 percent from 7.13 percent.

“As we anticipated, FHA and VA borrowers have been most impacted by the job losses thus far, with the share of Ginnie Mae loans in forbearance at almost 11 percent,” Fratantoni said.