The U.S. Senate has unanimously passed a bill designed to speed up the mortgage process for applications on tribal lands.

The Tribal Trust Land Homeownership Act was introduced by South Dakota Senators John Thune and Mike Rounds in January. It will now move on to the House of Representatives for deliberation.

“Affordable housing opportunities on tribal trust land can be hard to come by in South Dakota and across the nation due in part to the BIA’s challenging mortgage approval process, which can complicate lenders’ ability to provide financing to prospective homebuyers and participate in federal tribal housing programs. Our bipartisan legislation would expedite this mortgage approval process, hold the BIA accountable, and encourage more lenders to provide mortgages across Indian Country,” Thune and Rounds wrote in a press release.

The bill “sets forth requirements for the processing of a proposed residential leasehold mortgage, business leasehold mortgage, land mortgage, or right-of-way document by the Bureau of Indian Affairs.”

Under this legislation, the BIA must review submitted documents within 10 days, and approve or deny the application in 20 or 30 days, depending on the type.

It also lays out specific guidelines for response times, notification of delays in processing, and the form of notices and delivery of certain reports, as well as establishes a Realty Ombudsman position within the BIA to serve as an intermediary between the agency and tribal communities.

The Government Accountability Office will have to report on digitizing documents for the purpose of speeding up the completion of mortgage packages for residential mortgages on tribal land.

Bill Killmer, Senior Vice President of Legislative and Political Affairs for the Mortgage Bankers Association, applauded the bill.

“This important legislation will reduce or eliminate Bureau of Indian Affairs processing delays, improving access to credit by encouraging more lenders to participate in trust land mortgage lending. Addressing these processing delays and improving credit availability will go a long way in helping more Indigenous and Native families buy a home,” he said.

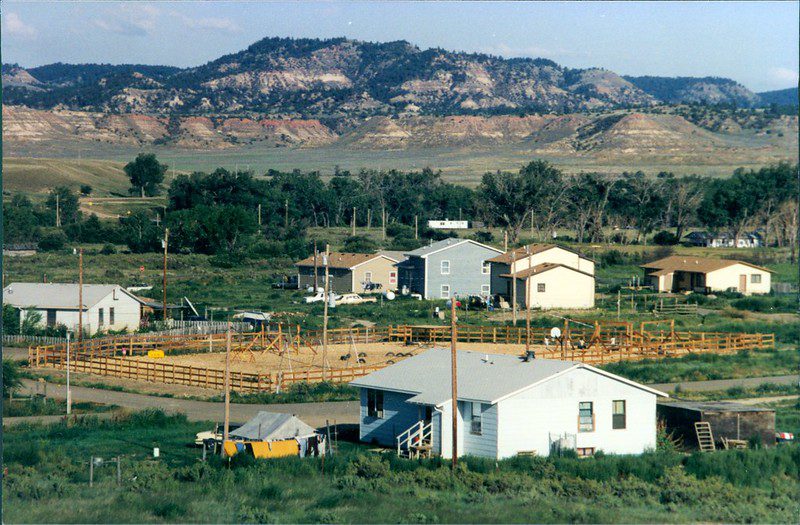

Native people face various hurdles on their way to homeownership. Of the approximately 5.2 million people who identify as American Indian and Alaska Native, only 56% own a home, lagging behind the national average. This is due to a combination of factors, including a high poverty rate for AIAN people and reservation restrictions that drive up the cost of housing.

With these barriers already so high, it is important that the mortgage process not add extra strain to prospective homebuyers, advocates say.

“It is essential that Native people have equal access to mortgage transactions, just like any other citizen in this country,” said Chelsea Fish, executive director at the National American Indian Housing Council. “This bill focuses on aligning the processes of the BIA with standard practices in the private mortgage industry.”

Read More Articles:

Snapdocs Founder Talks About The Value Of Digital Closings

Mortgage-Free Living: Are Americans Paying Off Their Houses?