Mortgage rates remain at record lows, but mortgage credit keeps getting harder and harder to obtain.

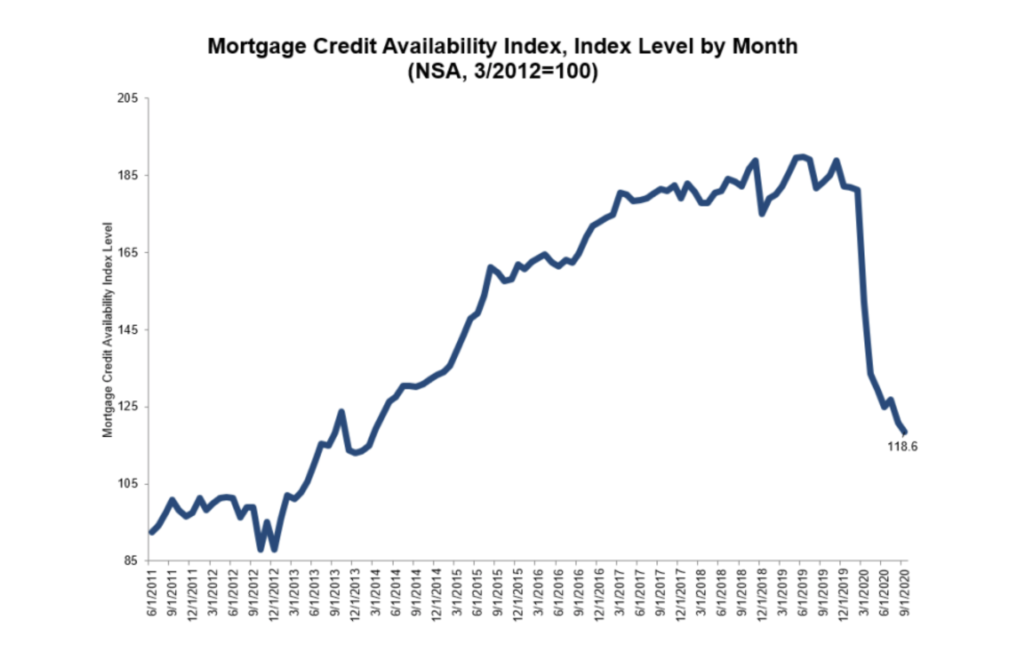

The Mortgage Bankers Association reports that mortgage credit availability decreased in yet again in September, reaching the lowest level since February 2014 and down roughly 50 percent this year.

The Mortgage Credit Availability Index (MCAI) fell 1.9 percent 118.6 in September, with the conventional loan MCAI decreasing 6.1 percent and the government MCA increased by 1.4 percent. The jumbo MCAI decreased by 2.1 percent and conforming MCAI fell by 9.5 percent.

“Across all loan types, there continues to be fewer low credit score and high-LTV loan programs,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The housing market overall is on strong footing, but the data show that lenders are being cautious, given the spike in mortgage delinquency rates in the second quarter, as well as the ongoing economic uncertainty.”

Here is a look at the MCAI over time: