Faced with inflation pressure and rising rates, many borrowers are seeking lower monthly mortgage payments in the form of ARMs or longer terms.

But lower monthly payments come with a price. LendingTree analyzed 380,000 loans to determine how much more borrowers with 30-year loans pay than those with 15-year loans.

They found that borrowers with 15-year fixed rate mortgages saved an average of $215,000 in interest across the loan’s lifetime.

Of course, 15-year loans also required borrowers to pay an average of $572 more a month in order to rack up those savings.

One reason shorter-term loans save borrowers so much money is that their interest rates are typically lower. The 30-year fixed rate averaged 5.89% last week, while the 15-year was 5.16%.

Shorter loan terms make more sense for some borrowers than others. LendingTree found that homeowners in California, Hawaii, and Washington could save $306,687 over the life of their loan. But West Virginians, Ohioans, and Missourians only saved $171,632.

The analysis concludes that 15-year fixed rates make sense for people who can afford the higher monthly payments and want to save money in the long run, while building equity fast.

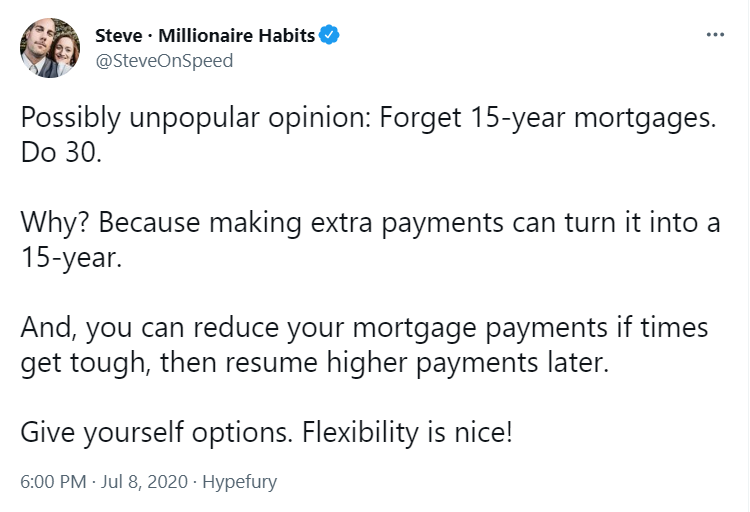

Not everyone agrees. Self-made millionaire Steve Adcock targeted 15-year fixed rates in a tweet, underscoring the flexibility of a lower monthly payment.

By this logic, a 15-year loan doesn’t make sense even for those who can afford the higher payments.

Greg McBride, chief financial analyst for Bankrate, agrees. “Money in the bank will pay the bills; home equity will not,” he told CNBC.