By Elise Daniel

When Vice President Joe Biden entered the White House in 2008, he inherited an economic recession and subprime mortgage crisis in which millions of people lost their homes due to foreclosure. Bank bailouts, stimulus packages, and financial regulation followed.

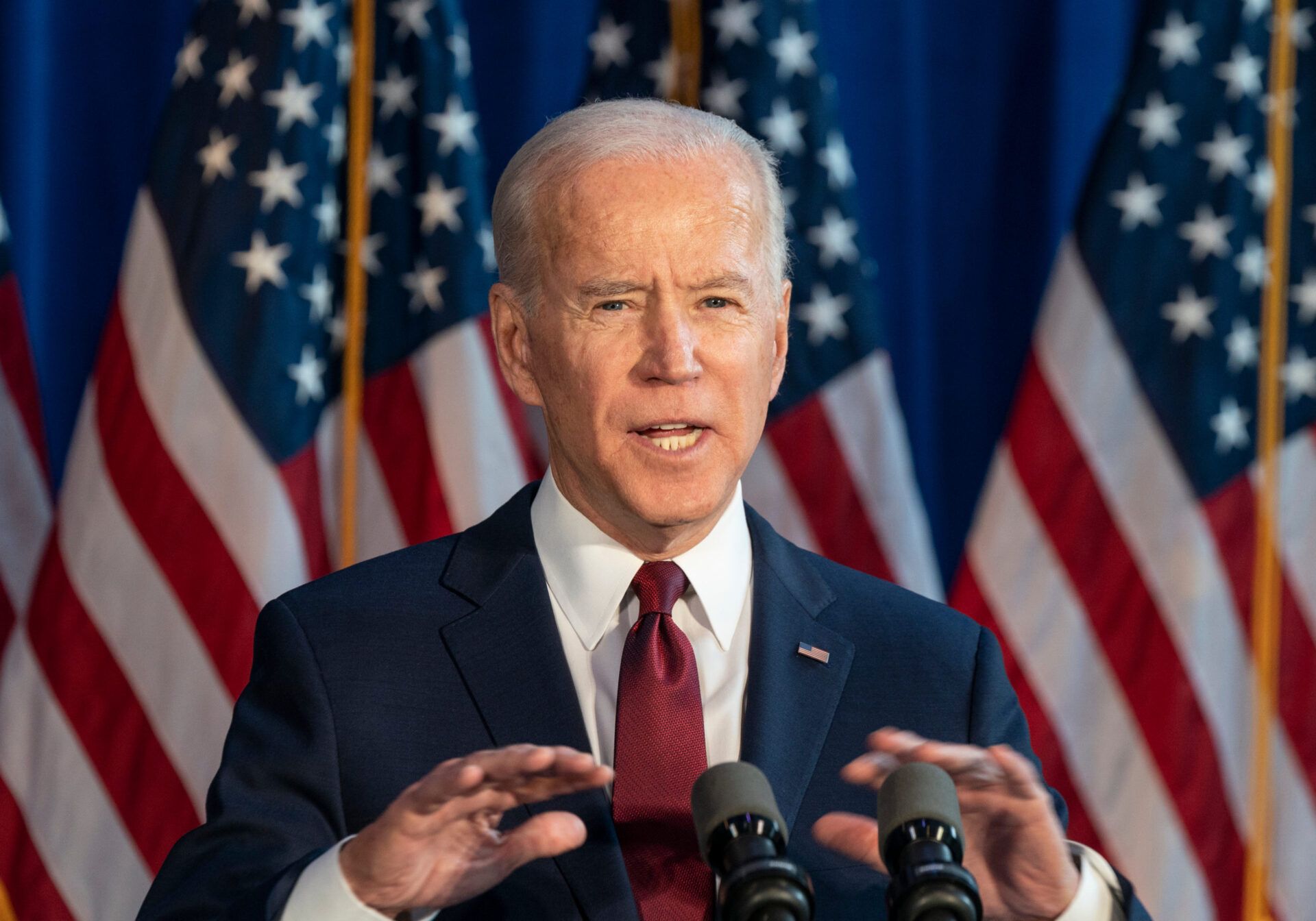

The burning question for lenders in 2021 is: How will President Biden, who’s been around this block before, respond to today’s complex housing market that has been propped up by forbearance and historically low interest rates?

Just hours after swearing in, Biden signed an executive order that pushed back the federal eviction moratorium to the end of March. He’s asked Congress to extend the grace period until the end of September and plans to call on the Federal Housing Finance Agency to extend the foreclosure moratorium as well, which is also currently set to expire on March 31, and continue forbearance applications for all loans guaranteed by Fannie Mae and Freddie Mac.

Many experts say Biden is only kicking the can further down the road, with some predicting an eviction crisis as well as another potential mortgage crisis when these stopgaps end. Mark Calabria, director of the Federal Housing Finance Agency, predicts a crisis for the lending industry, especially those companies offering high-volumes of federally-backed loans.

“In their current condition, Fannie and Freddie will fail in a serious housing downturn,” he told MarketWatch in November.

Lenders are worried they’ll take massive losses when these moratoriums expire.

While it’s always possible a Biden administration could push for another round of bank bailouts, Andrew Jakabovics, vice president of policy development at Enterprise Community Partners, argues direct payments to homeowners is a better solution.

“Last time we were in a housing crisis, we bailed out the banks. But if we would’ve just paid people’s mortgages, the money would’ve still gone to the banks without renters going through distress,” Jakabovics told Forbes.

That seems to be the direction the administration will take, at least initially. In the next stimulus package, it’s possible Americans will receive $2,000 checks. But even so, there’s no guarantee they will spend the money on rent or mortgage payments.

Interest rates

On the other side of the housing market coin is the refinance boom driven by low interest rates.

Though rates initially rose to 2.79 percent at the beginning of the year, they are dropping again and remain low by historical standards. However, economists predict that rates will rise steadily throughout the year as the economy recovers, but still remain low, right around 3 percent.

David Stevens, a former CEO of the Mortgage Bankers Association, told NBC that the Federal Reserve will have less of an incentive to pump money into the mortgage market as the economy improves.

“As the nation’s economy recovers … the need for the Fed to be there, buying up the mortgage-backed security supply, is going to be lessened, and you take out that biggest buyer. That’s going to put upward pressure on rates,” Stevens said.

While Biden’s administration has no direct control over mortgage rates, his impact on the economy can influence the central bank’s decision-making and inflation, two crucial factors that drive interest rates.

Financial analyst Lyn Alden suggests the Federal Reserve’s control of interest rates is limited, and that it’s inflation expectations we should turn our attention to.

“The Federal Reserve can control short-term interest rates, but has less control over longer-term interest rates, including mortgage rates,” Alden said. “Long-duration treasuries and mortgage rates will be priced by the market in significant part based on inflation expectations.”

Alden explains that inflation expectations rise when Congress passes stimulus packages because it requires increasing the money supply. If the Biden administration pushes for greater stimulus, which they are currently doing, then we can expect higher inflation.

“Inflation expectations will in significant part be a function of how much stimulus is passed by Congress and the Biden administration,” she said. “A situation with higher stimulus could start a more profound shift towards higher inflation, given that the broad money supply has already increased more than 25 percent since this time last year.”

Biden recently proposed a $1.9 trillion stimulus package, over twice the size of Trump’s last $900 billion stimulus package. According to Alden’s analysis, this would increase inflation expectations and, in turn, mean higher mortgage rates.

The housing market and lending market depend on a whole host of economic factors, but the lending industry would be wise to brace itself for a potential crisis when forbearance ends as well a slow down to the refinance boom as interest rates rise, especially if the Biden administration continues to pump the economy with stimulus.

Elise Daniel is a freelance writer and reporter for the Mortgage Note.