United Wholesale Mortgage President and CEO Matt Ishbia said his company is purposely avoiding mortgages that serve lower and some middle-income Americans.

“We are always on the higher credit score buckets at UWM and the lower rates at UWM. … We want lower rates, best quality borrowers, close them fast, get them to give you three referrals, and let’s keep dominating,” Ishbia said in an interview last week with the Association of Independent Mortgage Experts (AIME).

Ishbia made the comments from his office at a time when brokers are working to adjust the way they do business amid the COVID-19 pandemic. Some of the brokers with whom UWM does business have complained on social media and elsewhere that UWM is offering higher rates at higher costs than other companies while also refusing take on refinancing or FHA loans.

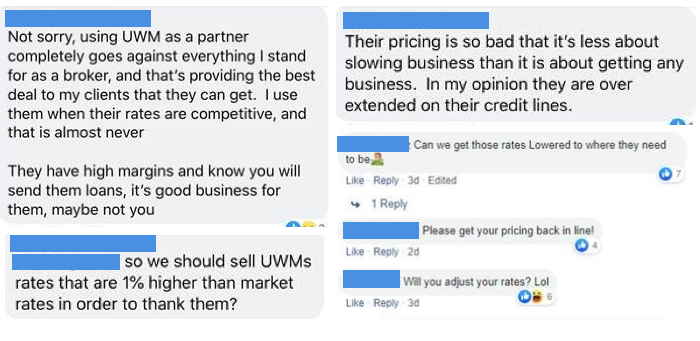

These comments were taken from brokers on the Brokers are Better Facebook page, as well as UWM’s Facebook page:

Overall, mortgage rates have crept back up due to high demand and a backlog of applications. Last week, mortgage rates rose for the second week in a row – up to 3.65 percent from 3.36 percent a week earlier and a low of 3.13 percent on March 2. This week, they edged down slightly to 3.50, Freddie Mac said.

“We aren’t everything for everyone,” Ishbia said. “There are some loans … that may not be UWM loans right now, and that’s OK.”

See also: Ishbia says “Everyone’s winning right now” during pandemic.

But some brokers say UWM’s prices and rates are noteworthy at a time when lower- and middle-income homeowners need relief and the opportunity to save money by refinancing.

“UWM’s prices are higher than others, but they still want purchase business,” said a Michigan real estate broker with more than 20 years in the business who requested anonymity so he could discuss private dealings with the company. “It is close to impossible to send them an FHA loan or any type of refinance. They just want clean easy conventional loans to sell.”

FHA mortgages, which are insured by the Federal Housing Administration, are designed for low- to middle-income borrowers and require lower down payments and credit scores than many other loans. They make up roughly 17 percent of the market.

Like other lenders, UWM has a complicated history with FHA loans. In December 2016, it agreed to a $48 million settlement with the Justice Department for failing to properly underwrite FHA loans over a six-year period.

Watch the full interview here.