By KIMBERLEY HAAS

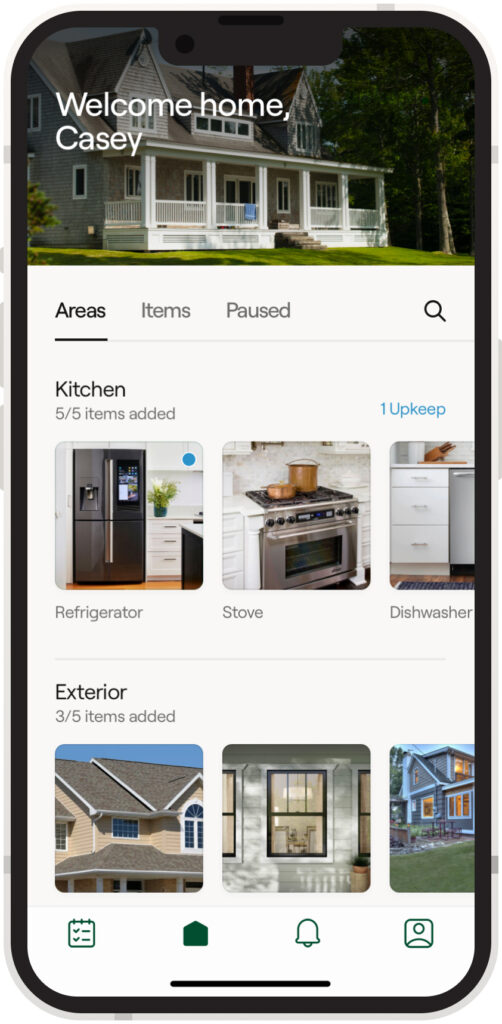

An app that helps homeowners maintain their property inside and out has been released by Consumer Reports and leaders there say this could potentially increase home values during the sale process.

Upkept users add items to their digital Home Hub and the app creates a plan to keep everything in tip-top shape. The roof, windows, boiler, cooling system, and appliances are examples of what can be added.

Changing water filters, deep-cleaning the interior, and cleaning the gutters can be added as reminders.

“It automatically schedules and then gently reminds you about doing tasks throughout the year, and then it walks you through each one step-by-step when you’re actually ready to roll your sleeves up and get to work,” said Rosaline Bernstein.

Bernstein is the Product Leader for New Ventures and Home Services at Consumer Reports. She sat down for an interview with The Mortgage Note to talk about their product, which was launched in the fall.

When asked if homes that are well maintained sell for more money, Bernstein said that is their hunch.

“We’re still pretty new so we don’t, unfortunately, have the numbers to back it up and say, ‘Yes absolutely,’ but what we have been seeing along the way of building the app is that maintenance isn’t cosmetic. When you are going to sell a house you can hide cosmetic damage. You can change a paint color, but when it comes to keeping your house in good shape, your systems and the appliances, it’s things that could make or break a home sale and you can’t hide it,” Bernstein said.

Appraisers look at the overall quality and condition of a home as required by lenders, so even if a potential buyer waives inspection, maintenance of a property will be taken into consideration during the home selling process.

For sellers, a low appraisal can mean they have to accept less for their home than the offering price unless they include language to protect themselves before signing the offer.

If a homeowner is going to refinance their loan, lenders also require an appraisal.

In a January blog post for Rocket Homes by Holly Shuffett, it is advised that homeowners document any upgrades they have made which could boost value.

“Refinancers should follow the same advice given to sellers: Put your home’s best foot forward for the appraiser by tidying up and preparing documentation of any upgrades that could boost its value,” Shuffett wrote.

Upkept has a variety of tips for the spring season to keep a home and property well maintained.

Checking the foundation, walls, window sills, and baseboards for pests is considered a basic task by the creators of the app.

To prevent infestation, it is suggested that homeowners make sure there is no wood, including stacked firewood, touching the ground next to foundation walls. Holes dug by animals or snakes should be filled.

Termites or carpenter ants may require an exterminator.

An example of a critical task is checking the foundation for hairline cracks and making repairs.

If left unchecked, minor foundation problems will lead to major stability issues that can easily cost more than $10,000 to repair.

Large cracks require a structural engineer to assess the situation.

Holes and cracks should be fixed on walkways as well. That is considered an important task.

Upkept is free for 30 days, and then costs $4.99 a month after that trial time expires.

See More Articles By Kimberley Haas:

Building Slowed Down By Shortage Of Electrical Transformers

Guild Mortgage Gets Ahead With “A Customer For Life” Strategy

Love It Or List It? Americans Are Renovating Rather Than Moving

Story ideas? Email Editor Kimberley Haas: [email protected]