Declaring “a true partner doesn’t tell you how to run your business,” Rocket Mortgage is firing back at United Wholesale Mortgage in the Great Broker War of 2021.

Days after UWM announced it would not do business with brokers who work with Rocket and another company, Rocket accused UWM of restricting brokers’ freedom of choice simply because Rocket is cutting into its market share.

“Being a broker embodies the very concept of freedom,” Austin Niemiec, executive vice president at Rocket ProTPO, wrote in a letter to brokers. “Freedom to be a business owner. Freedom to choose lenders. Freedom to choose programs and pricing. Freedom to do what you think is best for your clients. Giving up that freedom means giving up one of the core tenets of being a mortgage broker.

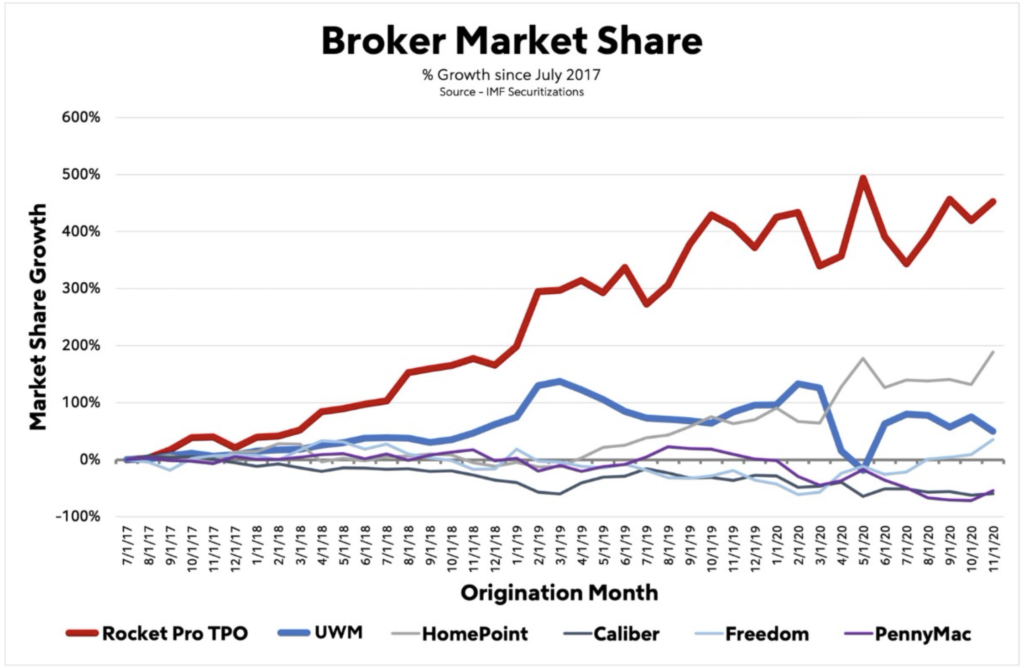

“Why would UWM ask mortgage brokers to give up their freedom and their superpower of choice? It’s not because of any morals or a principled stance, like they so aggressively claim. It’s fear. A quick glance at the numbers plainly shows why UWM has reacted so desperately.”

HousingWire reported Monday that Rocket closed $97 billion in mortgages with brokers last year, making it the second biggest broker partner in the industry behind UWM ($182 billion). Overall, Rocket did $320 billion in mortgage originations in 2020, while all of UWM’s business comes through brokers.

That number – along with Rocket’s market share – is growing, Niemiec said. Rocket provided the following chart that shows Rocket’s market share in the broker space is growing significantly.

See Niemiec’s full letter and video here, in which he says UWM has “lost the will to compete to earn your business.”

Last week, UWM CEO Mat Ishbia accused Rocket and its business practices of being bad for brokers and said he would cut off any brokers who worked with Rocket.

“Starting today, we are not helping those that help them. If you work and send loans and send business to Fairway Independent or Rocket Mortgage, which by the way is about 25 percent of the brokerage channel works with either of them. … If you work with them, can’t work with UWM any more, effective immediately,” Ishbia said on a Facebook Live. “I can’t stop you, but I’m not going to help you, help the people that are hurting the broker channel. We don’t need to fund Fairway Independent or Rocket Mortgage to try to put brokers out of business.”

The Association of Independent Mortgage Experts issued a statement in support of UWM, its longtime partner and title sponsor.

“AIME is dedicated in our mission to protect, support, and grow the broker community alongside our title sponsor, UWM,” AIME CEO Katie Sweeney said. “Our organization chooses to only partner with lenders who are fully aligned with supporting the growth of the broker channel, as the longevity of the entire broker community is a founding principle of our organization.

“Each of our sponsors are held to a high standard of accountability to ensure the continued growth and support of the broker community. Brokers deserve better than to be used for lead generation – which is precisely why we’ve never partnered with Rocket TPO or any other lender with similar business practices.”

Read Also: AIME Loses 2 Of 3 Platinum Sponsors

Conversely, the National Association of Mortgage Brokers had harsh words for UWM’s stance.

“We’re not sure this is even legal. It certainly isn’t ethical,” NAMB President Kimber White said. “And it doesn’t represent the American way of free enterprise. This is counter to the spirit of freedom and independence that is the very foundation of our broker businesses. You should be allowed to work with whomever you want and who offers the best product and customer service. Not a company that dictates your business model to you. At NAMB, we support all lenders and your choice for whomever best supports you, your business, and your borrowers. We’re NAMB for all.”

David Stevens, the former CEO of the Mortgage Bankers Association and a former FHA commissioner, echoed that sentiment and called UWM’s announcement “one of the most bizarre things I’ve seen in my career.”

“A mortgage broker value proposition is that they offer loans from a variety of lenders and are not beholden to one like other lenders,” said Stevens, now CEO of Mountain Lake Consulting. “But this action from UWM says that you need to be beholden to one or get cut off. … Competition makes the business better and provides consumer choice. This is extremely odd, and frankly sounds like an advertisement for Quicken Loans and Fairway. In other words, it sounds like, `you are beating me in price and/or service so I am cutting you off.’”