The data and analytics company Black Knight reports the July’s numbers show the national mortgage delinquency rate dropped 5 percent in July and is now approaching pre-pandemic levels. However, about 1.45 million borrowers remained 90 or more days past due – though not yet in foreclosure – more than 1 million more than at the onset of the pandemic.

“Delinquencies have now improved in 12 of the last 14 months, with the two monthly increases being calendar-related as opposed to being indicative of worsening performance,” the company reports.

Their analysis follows last week’s news that the number of homeowners exiting mortgage forbearance is up.

The “total number of loans now in forbearance decreased by 14 basis points from 3.40% of servicers’ portfolio volume in the prior week to 3.26%,” the Mortgage Bankers Association said in its weekly forbearance report.

However, Black Knight warns, there could still be trouble ahead due to the federal foreclosure moratoria expiring at the end of July.

“While the number of loans in active foreclosure fell by 5,000 to yet another record low, potential foreclosure activity in the coming months warrants close observation,” Black Knight reports.

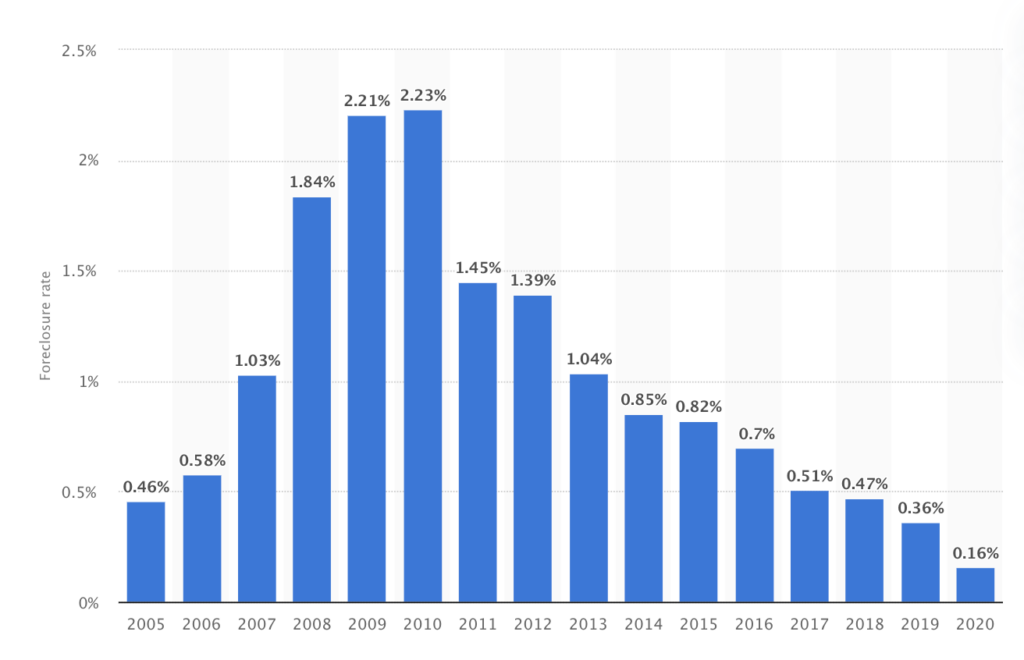

Foreclosure rate in the United States from 2005 to 2020

While foreclosure rates have been steadily falling since the Great Recession, during the 2020 COVID pandemic, the rate fell by 56 percent, the biggest single-year drop since 2011. Most of that was due to government restrictions on foreclosure activity during the national health emergency.