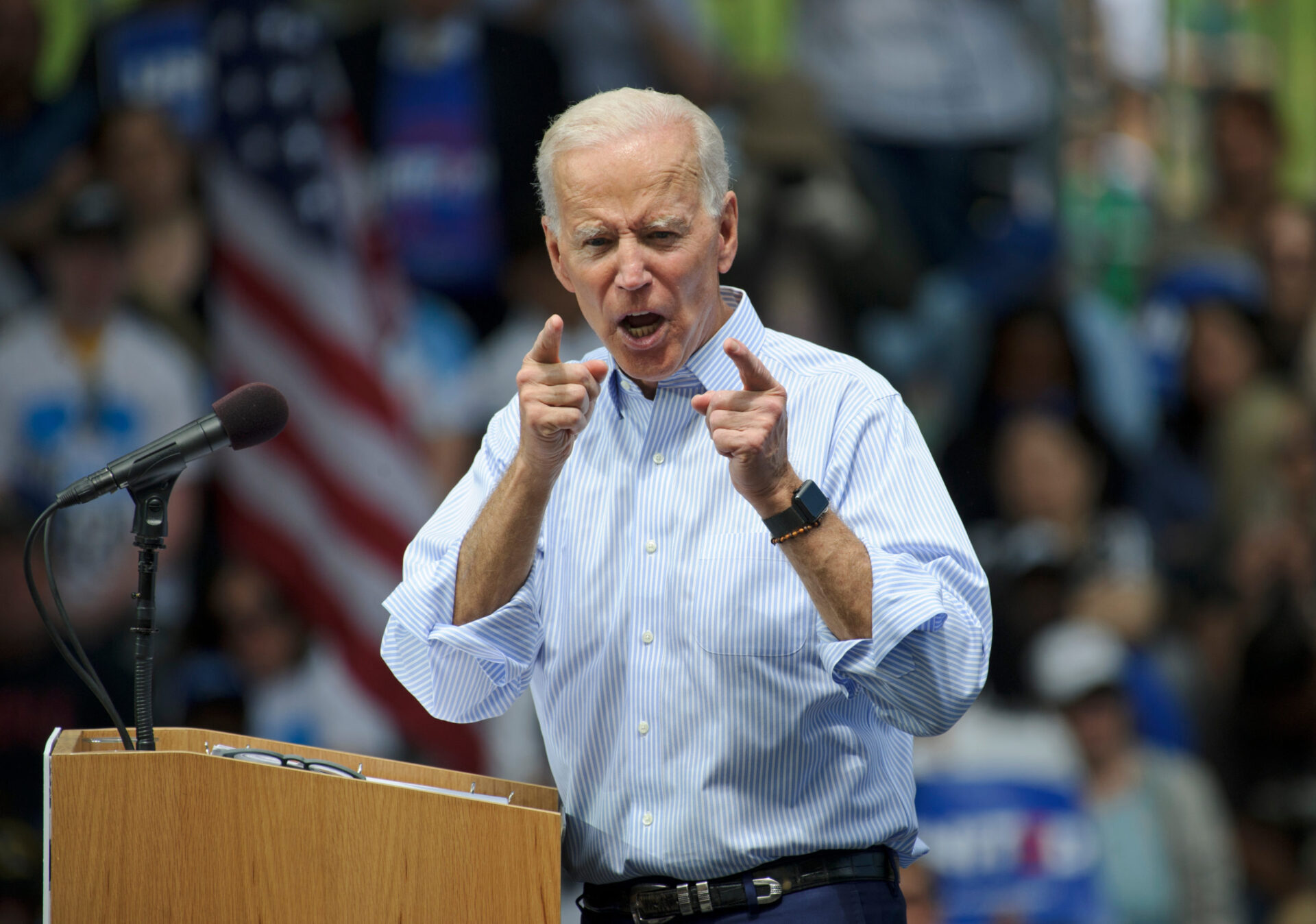

Biden leads Sanders in projected Super Tuesday primary results. The coronavirus spreads in Washington state as an Amazon employee tests positive. NASA is taking applications for people to travel to Mars and the moon.

And in mortgage news …

The Mortgage Note rounds up reactions and analysis from the Federal Reserve’s emergency rate cut.

A USA Today editorial warns that the Fed’s rate cut leaves little room for a stimulus to address the next recession.

The Mortgage Bankers Association announced that commercial and multifamily mortgage delinquencies remained at or near record-low delinquency rates.

Insurance companies and lenders are responding to climate change by shifting risks to taxpayers.

Housing Wire provides an analysis of how the coronavirus will affect the housing market long term.

NerdWallet offers consumers advice on how to take advantage of coronavirus interest rate cuts.

Title insurance giant First American announced it has acquired Docutech, a document, eSign, eClosing and compliance technology provider. The acquisition continues a move toward fully digital mortgages and mortgage closings.

Real estate borrowers are distancing themselves from the Secured Overnight Financing Rate (SOFR) benchmark reference rate index named to replace the U.S. Dollar London Interbank Offered Rate (LIBOR). Most will wait until banks are on the same page, before using LIBOR’s replacement.