Good morning! Today is Thursday, December 10. Facebook is being hit with antitrust lawsuits by the Federal Trade Commission and a bipartisan group of 46 state attorneys, accusing the social media giant of a yearslong campaign to buy up or freeze out potential rivals. SpaceX’s Starship prototype exploded during a test flight landing. The World Surf League will find another location for the women’s Maui Pro event, after a shark attack halted competition.

And in mortgage and housing news …

MORTGAGE CREDIT: Mortgage credit freed up in November to its highest level since July, according to a new report released by the Mortgage Bankers Association.

MORTGAGE APPS: Mortgage applications dropped slightly last week, while remaining significantly higher than 2019 levels, according to a report released by the Mortgage Bankers Association.

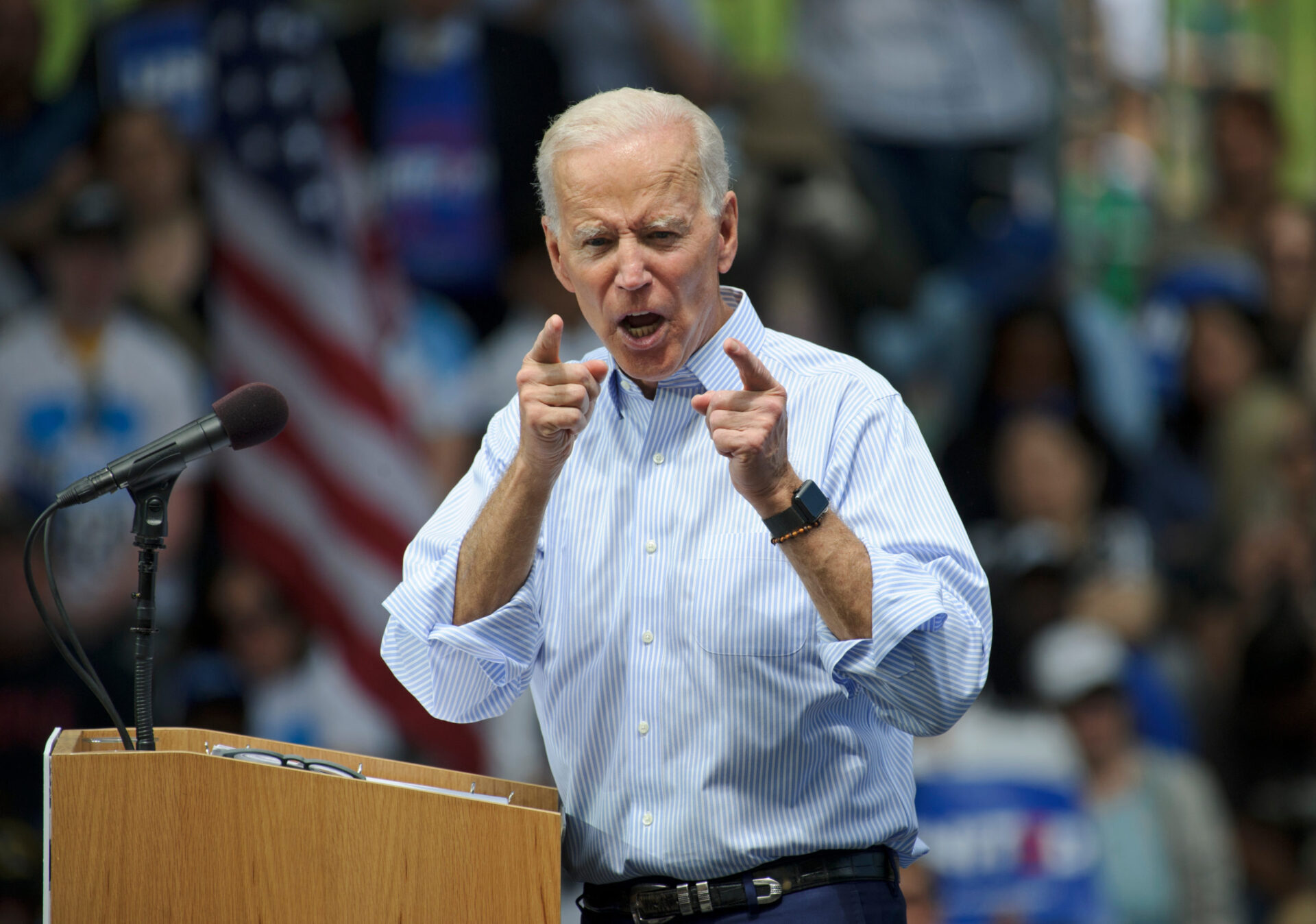

BIDEN BUMP: How real estate may benefit from a Biden presidency, and how it may not.

EQUITABLE HOUSING MARKET: Homes in Black neighborhoods are underpriced by about $156 billion, according to Andre M. Perry of the Brookings Institution. He has ideas on how to change that number.

LOAN SERVICER WARNING: The $91 million Mr. Cooper settlement for mishandling foreclosures and borrowers’ payments is being seen as a warning to mortgage loan servicers not to prey on borrowers during the pandemic.

RECOVERY: More than 40 percent of company CEOs believe business conditions will recover to pre-pandemic levels in 2021, according to a new quarterly survey from the Business Roundtable.

HOMES APPRECIATE: Homes are appreciating at the fastest rate since 2014.

RESTAURANTS STRUGGLE: The National Restaurant Association reports 110,000 restaurants have closed permanently during the COVID-19 pandemic.

COMPARISON SHOP: Though average mortgage rates have dropped to extreme lows never seen before, if you’re buying a home or refinancing you can’t assume that a lender will always offer you a deeply discounted rate.

DURABLE MARKET: Metro-Denver’s housing market has staying power.

FORECLOSURE PURCHASE: How to buy a foreclosed home.