Good morning! Today is Monday, October 12. Senate confirmation hearings begin this morning for Supreme Court Justice nominee Amy Coney Barrett. Tech workers leaving the San Francisco Bay Area to work remotely amid the pandemic are being asked to take pay cuts of 15 percent or more, as tech companies make cost-of-living adjustments. Lakers fans gathered at Staples Center to celebrate the team’s first NBA championship win in a decade.

And in mortgage and housing news …

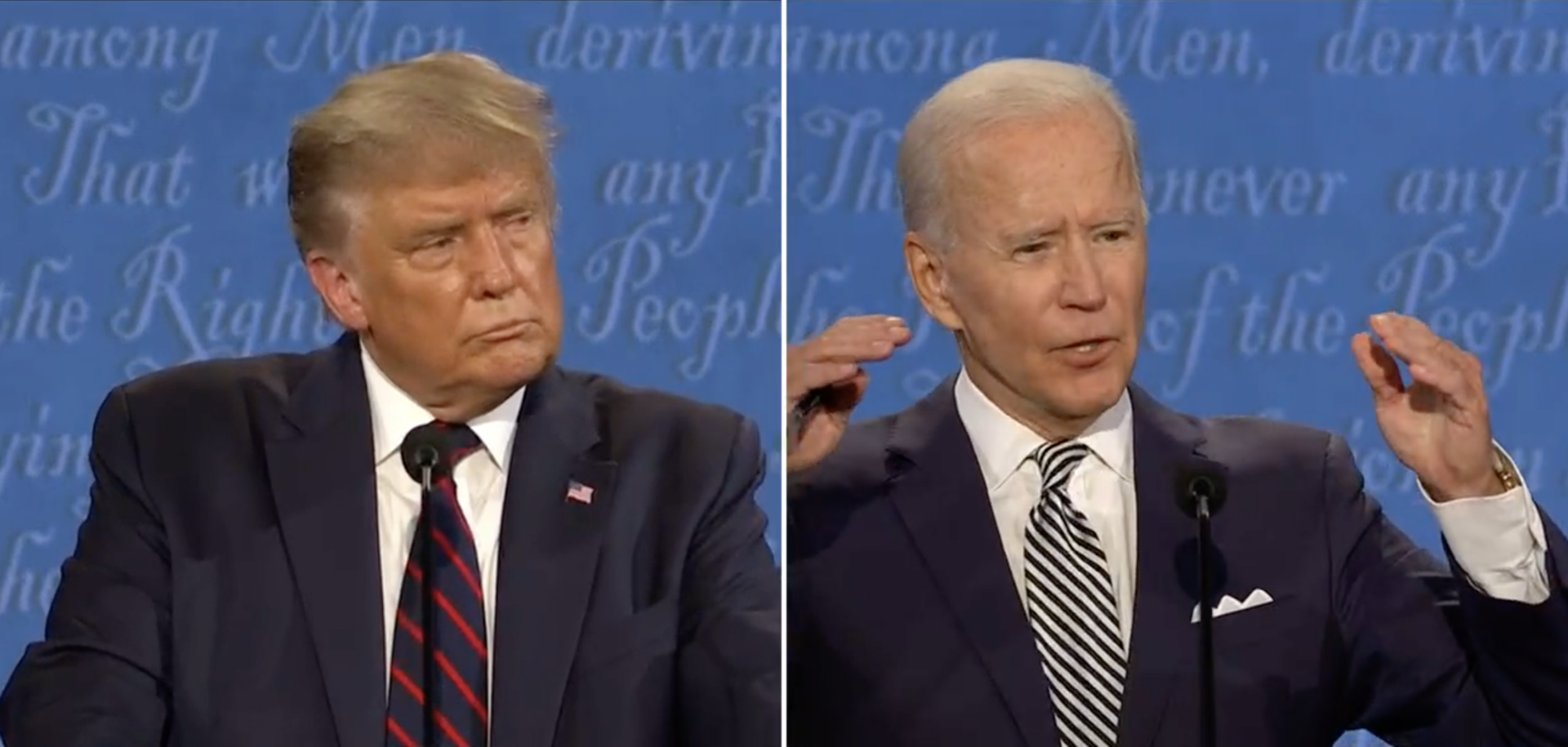

PRESIDENTIAL POSITIONS: Where Biden and Trump stand on mortgage finance issues.

FED’S MAIN STREET LENDING: Only about $2 billion worth of Federal Reserve program loans have been issued so far through the $600 billion program, many of them by City National Bank of Florida.

MORTGAGE PAID OFF: Paying off your mortgage is a milestone to celebrate, but it’s also a moment to take specific steps to ensure you’re the legal owner of the property, and to continue paying your homeowners insurance and property taxes on your own.

PAIN AND PARTICIPATION: Americans behind on rent and mortgage payments are less likely to vote.

ULTRA-LUXURY INVESTMENT SPREE: How Citadel CEO Ken Griffin built a $1 billion private property portfolio.

SBA PPP FORGIVENESS: The Small Business Administration began approving forgiveness applications and remitting forgiveness payments to PPP lenders for PPP borrowers on Friday, October 2.

STUDENT LOAN DEBT: College borrowers aren’t always seeing Covid-19 relief. Here’s why.

EXTRA JUMBO LOANS: The ultra-rich are using giant home loans to access cheap credit. JPMorgan issued a $42.5 million loan on a New York penthouse owned by a Russian billionaire’s family.

RECOVERY: Despite aid programs, thousands went bankrupt in North Carolina as COVID-19 raged.

RESIDENTS SUE BANKS: Flint residents sue investment banks JP Morgan Chase and Wells Fargo over water crisis.

CHASE EQUITY PLAN: JPMorgan Chase announced a plan to commit $30 billion toward philanthropic workaimed at advancing racial equity.

MORTGAGE SWEEPSTAKES: DSW announced that it would pay select customers’ mortgage or rent for a year as part of a new sweepstakes event.