Good morning! Today is Friday, January 29. General Motors announced it will sell only zero-emissions vehicles by 2035. The New York Attorney General says the state’s nursing home deaths were undercounted by 50 percent. A faster-spreading South African variant of the coronavirus was detected in the U.S.

And in mortgage and housing news …

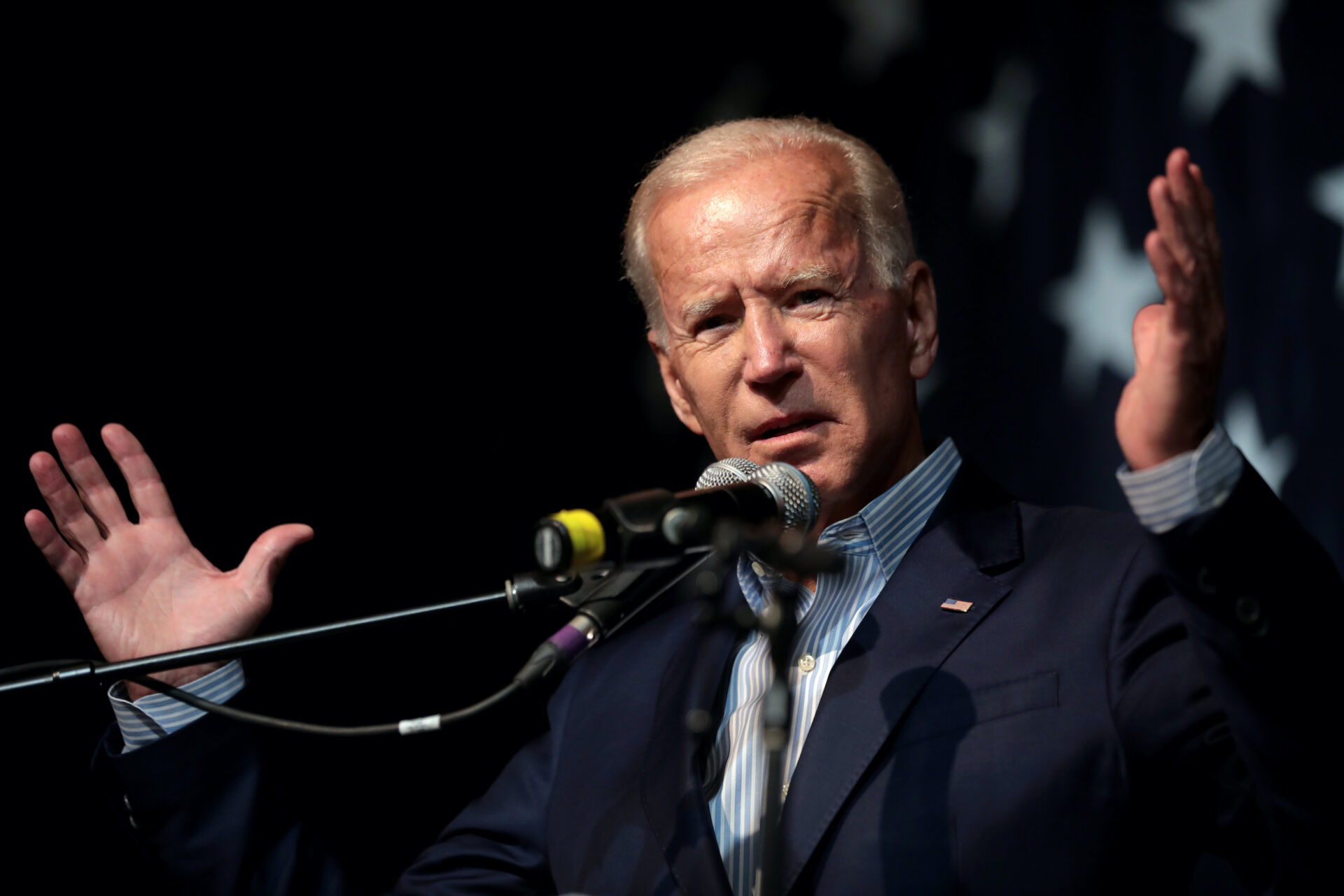

BIDEN IMPACT: The burning question for lenders in 2021 is: How will President Biden, who’s been around this block before, respond to today’s complex housing market that has been propped up by forbearance and historically low interest rates?

DOWNPAYMENT OPTIONS: There may be an upside for the young adults who were forced to move back home with their parents during the pandemic.

MORTGAGE RATES: Mortgage rates fell for the second consecutive week, inching closer to the record low levels set earlier this month, according to Freddie Mac’s weekly Primary Mortgage Market Survey.

FAIR HOUSING RULES: President Biden signed an executive action directing the Department of Housing and Urban Development to examine the impact of the Trump administration’s changes to fair housing rules.

HOUSING DISCRIMINATION: Researchers are calling on President Biden to go beyond HUD to address housing discrimination.

FANNIE MAE EXITS: Fannie Mae sees more exits in leadership at an important moment for the mortgage giant.

MERIDIAN EXPANSION: Commercial mortgage brokerage Meridian Capital Group has partnered with investment manager Barings to create a new agency lending platform, with former Freddie Mac CEO David Brickman as CEO.

SIGHT UNSEEN: A record number of home buyers are making offers on properties they haven’t physically viewed in person.

PROCRASTINATION COSTS: Forecasters are predicting slightly higher mortgage rates moving forward, which should give would-be borrowers plenty of motivation to stop procrastinating.

SEASONAL RHYTHMS: Understanding the seasonal patterns of mortgage rates.

DEBT: Should homebuyers pay off their debt before purchasing a home?