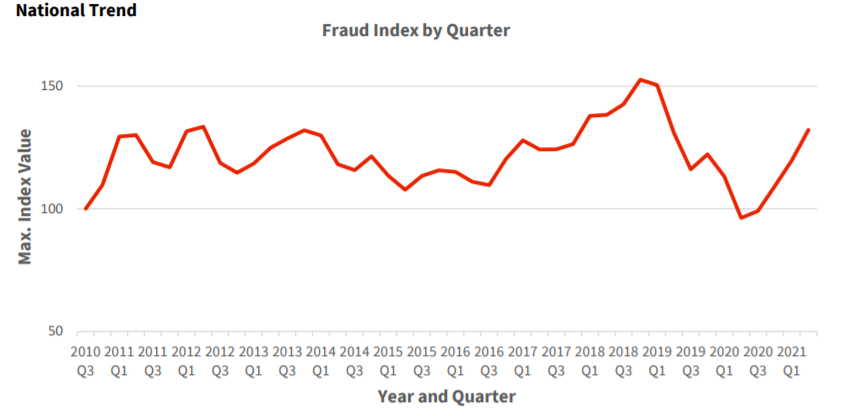

Mortgage fraud rose 37.2% year-over-year (YOY) through Q2, reaching pre-pandemic levels, according to CoreLogic’s latest Mortgage Fraud Report.

The increases are artificially high given the significant drop in fraud during 2020, which was driven by jumps in traditionally low-risk refinances. The current level mimics mid-2019.

“Refinance opportunities that surged lending volumes during the pandemic may be winding down. The outlook is for fewer low-risk refinances compared to purchases and cash-out refinances, which translates to a higher-risk environment for fraud,” said Ann Regan, executive, product management at CoreLogic.

According to the Mortgage Bankers Association, increasing interest rates have hampered refinance activity, with applications spiraling to their lowest point since January 2020. Purchase applications have picked up slightly.

About 0.83% of all mortgage applications contained fraud in Q2 2021, or 1 in 120 applications. It was 0.61% in Q2 2020, or 1 in 164 applications. However, though the overall fraud risk dropped in 2020, risk in the purchase segment rose 6%. Investment properties presented the highest risk for both purchases and refinances.

Transaction risk increased 34.2% YOY, while income and property fraud risk fell slightly due to a strong job market and home price growth.

The FBI characterizes mortgage fraud as “material misstatement, misrepresentation, or omission in relation to a mortgage loan which is then relied upon by a lender.” Fraud for housing, in which the goal is to acquire a house, is considered distinct from fraud for profit, for which making money is the goal.

Under both federal and state law, mortgage fraud carries a sentence of up to 30 years in prison and up to $1 million in fines.

The states with the highest risk increases are South Dakota, Washington, Alaska, Vermont, and West Virginia. This is because they are less populated, with lower levels of lending activity. They all had below-average index values in 2020.

Nevada had the highest risk for mortgage application fraud, followed by New York, Hawaii, Florida, and California.