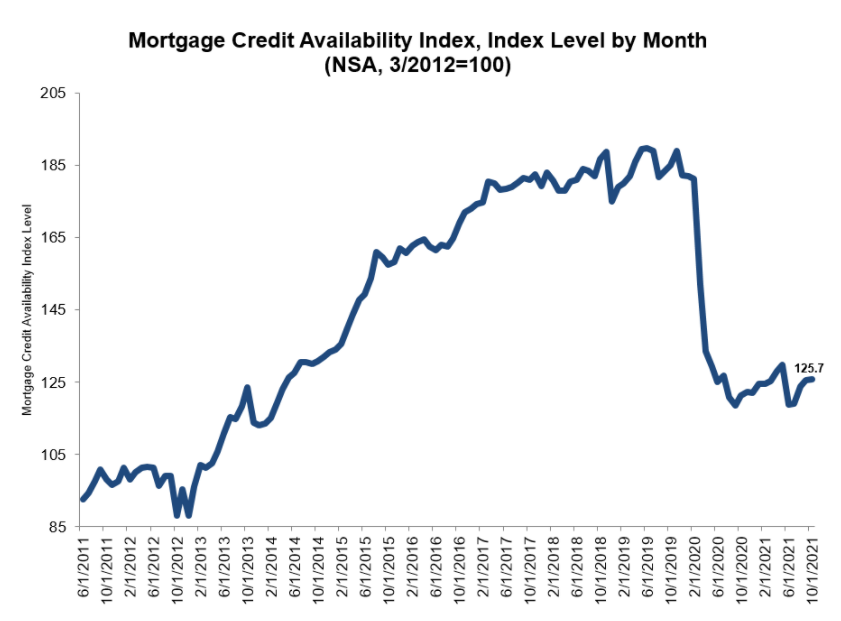

Mortgage credit availability rose only slightly in October, according to the Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index (MCAI). The index analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

The MCAI rose to 125.7 by only 0.1, showing credit loosened just a little. The Conventional MCAI increased 0.1%, while the Government MCAI was unchanged. The Jumbo MCAI increased by 4.1%, and the Conforming MCAI fell by 6%.

While any increase in credit availability is good, overall credit availability remains low.

“Credit availability inched forward in October, but the overall index was 30 percent lower than February 2020 and close to the lowest supply of mortgage credit since 2014,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting.

The 4% jump for jumbo credit, boosted by an increase in the supply of jumbo ARM and non-QM products, was ultimately canceled out by the drop in the conforming index.

“On the conforming side, there was a pullback in ARMs, higher LTV loans, and lower credit score products. While there is tightening in ARM credit availability both for jumbo and conforming loans, ARM loans have accounted for a small share of loan applications, ranging from 2.5 percent to 5 percent of applications to date in 2021,” Kan said.

Kan noted that tight credit availability poses “significant” problems for first-time buyers navigating a hot housing market rife with cash-based bidding wars and inventory shortages.

The share of first-time buyers has fallen from 46% in 2018 to 37% in 2021. Older buyers who own their current homes have an advantage in a cash-flooded market where properties are selling above their list price.

As equity has skyrocketed and houses consistently selling over asking price, current homeowners have an advantage over first-time Millennial buyers without as much to bid.