Good Morning! Today is Tuesday, September 6. Liz Truss will succeed Boris Johnson as Britain’s prime minister after colleagues tired of Johnson’s scandals forced him out. The U.S. says Russia is buying millions of shells and rockets from North Korea. A judge granted Trump’s request for a special master to review documents seized by the F.B.I.

The Mortgage Note Reports

Affordability Hit: Interest rates rose again last week as the Fed continues its battle against inflation, causing more problems for affordability.

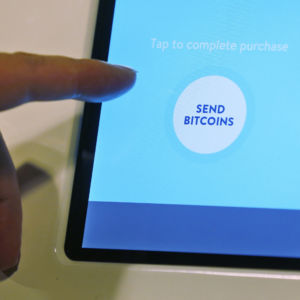

Milo Offers Crypto Refi: Crypto-lender Milo Credit has launched the first-ever cryptocurrency refinance product.

Do you have an idea for an article you would like to share? Email [email protected].

In other mortgage and housing news…

CoreLogic HPI: Annual home price growth slowed for the third consecutive month in July but remained elevated at 15.8%.

Jobs Outlook: Nonbanks cut payrolls for the third consecutive month in July, with the number of mortgage jobs at non-depositories down to 405,000.

Blend Hire: Blend Labs announced it has hired tech industry veteran Dean Klinger as its new Head of Revenue.

Layoffs Cont’d: Homepoint is laying off “hundreds” of employees, hoping to cut costs by more than $100M a year in response to an “extremely challenging” market.

40-YR IO: Newrez launched a 40-year fixed-rate interest-only option that it says was developed for borrowers who have been priced out of today’s housing market.

Development Stand-Still: Affordable housing developers are stalling work on new projects, delaying thousands of units from coming to market.

Take A Look: How fast are prices falling in America’s largest markets?