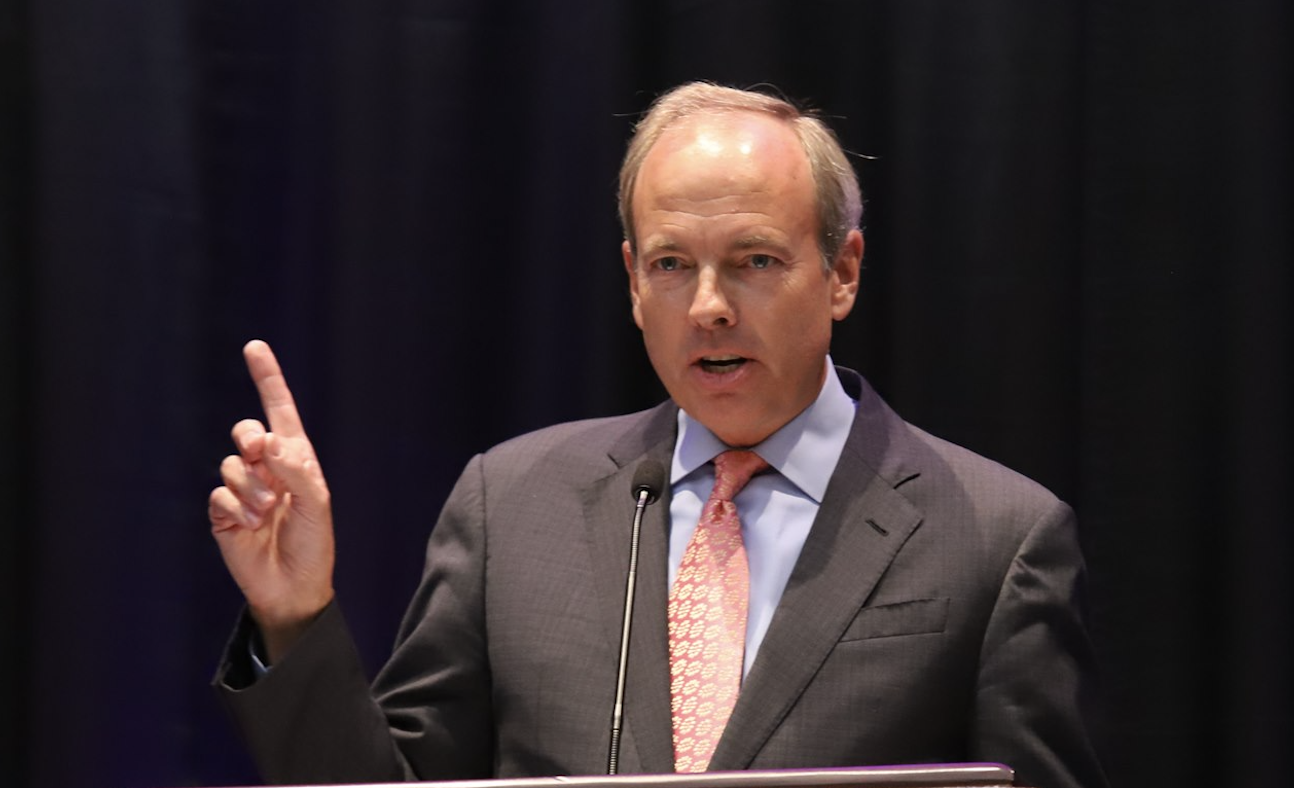

In a speech to the Mortgage Bankers Association’s annual convention on Monday, President and CEO Bob Broeksmit told members that, to paraphrase former President Bill Clinton, the era of big, regulatory government is back.

Broeksmit’s remarks addressed a range of issues, from the impact on the industry of the COVID-19 pandemic to minority homeownership. But his central theme for the industry is the political changes made in Washington, D.C. in 2020 are going to have an impact in 2021 — and beyond.

Broeksmit said he spoke to Fed Chairman Jerome Powell and four of the other Governors of the Federal Reserve.

“I always make the same points, too. The MBA supports regulation and legislation that is clear, easy to implement, and helpful to your companies and the millions of Americans you serve,” Broeksmit said. But he acknowledged the tide of low regulation has turned.

“We have our work cut out for us. We’ve entered another era of less guidance and more enforcement,” Broeksmit said. “An aggressive regulatory posture is back.”

This puts the mortgage lending industry in the same position as many other sectors of the economy, from energy to education, where the Biden administration is stepping up federal oversight and re-regulating private businesses.

Broeksmit specifically mentioned the Consumer Financial Protection Bureau as “one of our biggest focuses.”

“We were disappointed to see the bureau delay the new QM Rule until October 2022. The final regulation came from an open process that reflected our input and had the support of consumer advocates. It was a well-crafted rule, but the delay makes compliance more confusing and discourages innovative business models and the responsible expansion of credit,” Broeksmit said.

Another area of concern is the tax policy inside the multi-trillion-dollar reconciliation budget currently being debated in Congress, in particular taxes on capital and small businesses.

“The bill will include tax hikes,” Broeksmit acknowledged. “But we’re fighting to block the wrong tax hikes. We’re fighting efforts to raise taxes on mortgage servicing. We’re equally focused on preserving pass-through deductions which are critical to tax parity for our member firms.”

The pass-through deductions issue is a political hot potato. Many small businesses are structured as pass-throughs: They don’t pay taxes at the company level, the individuals who own the company pay the taxes. And according to Republicans like moderate Sen. Rob Portman of Ohio, the current proposal would mean a massive tax increase for these businesses.

“In all, the more successful pass-through companies should expect their federal tax rate to rise from about 29.6 percent today to about 46.4 percent under the Democrats’ new plan. 46.4 percent taxation on small businesses,” Portman said in an October 7 speech.

Broeksmit also called out the bill’s “treatment of capital gains and treatment of gains on the sale of homes.

“There are better ways to generate revenue than stifling investment and punishing working families,” Broeksmit said.

As COVID-era protections for borrowers and renters wrap up and inflation appears on the horizon, Broeksmit also offered a message of reassurance.

“The MBA was made for this moment. We’ve got your back. And we’re in front of every fight.”