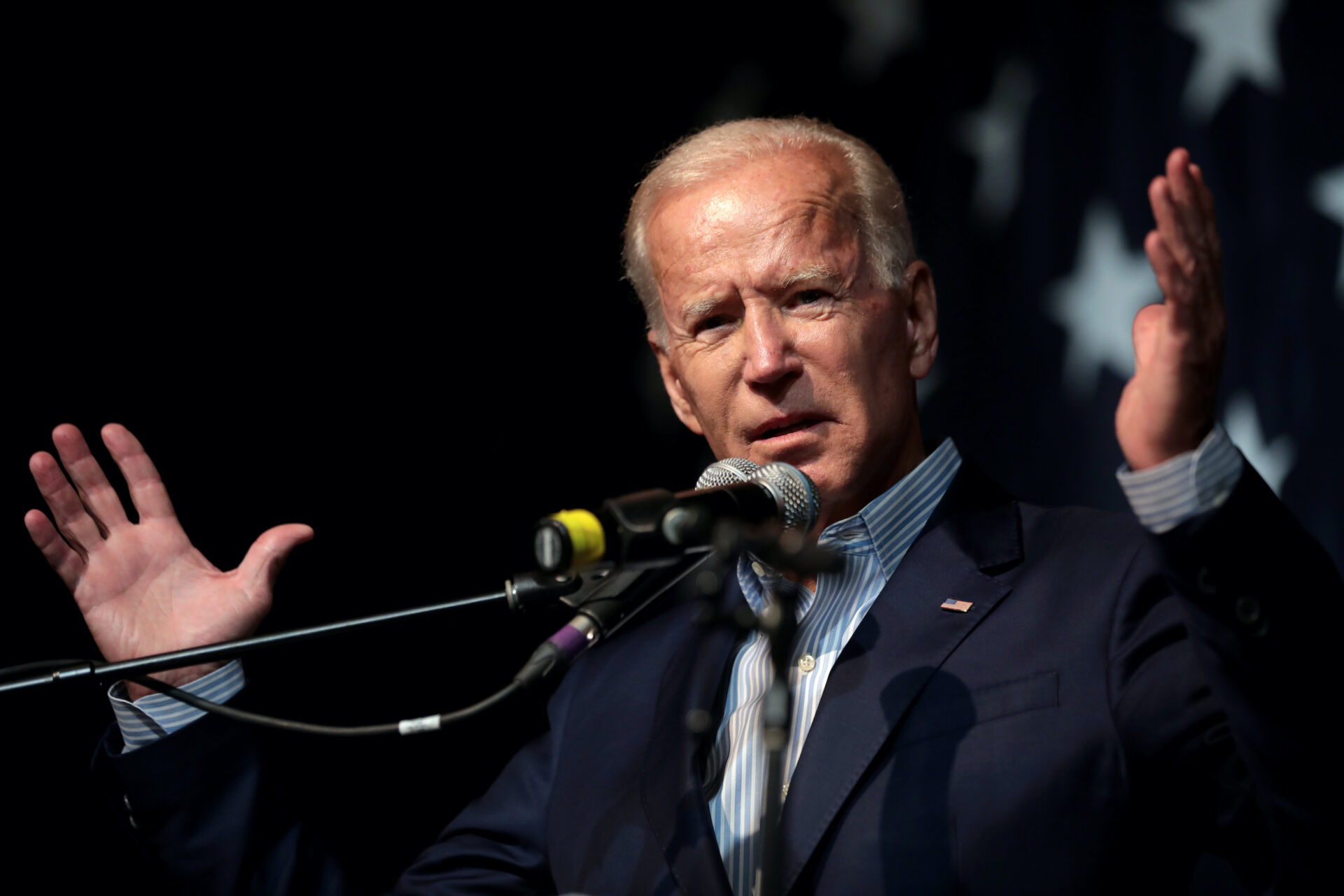

The Mortgage Bankers Association congratulated former Vice President Joe Biden for his victory in the presidential election, vowing to work with his administration on affordable housing and to assist homeowners impacted by the pandemic.

“MBA looks forward to working with President-elect Biden, Vice President-elect Harris, his administration, and the new Congress on the wide variety of issues impacting borrowers, renters, and commercial lenders and property owners,” said Robert D. Broeksmit, President & CEO of the Mortgage Bankers Association. “This includes access to affordable housing for all Americans; helping first-time homebuyers enter the market; assisting owners, renters, and landlords negatively affected by the COVID-19 pandemic; and ensuring liquidity and a level playing field for lenders and borrowers alike.”

In February, Biden released a $640 billion housing plan that is designed to provide access to affordable, safe and energy-efficient homes that are “located near good schools and with a reasonable commute to their jobs.”

Biden’s plan includes a refundable, advanceable tax credit of up to $15,000 for people buying their first homes; the creation of a $100 billion Affordable Housing Fund to build new and improve existing affordable housing; and ending “discriminatory and unfair practices” in the housing market.

“Housing should be a right, not a privilege. Far too many Americans lack access to affordable and quality housing,” the Biden campaign said in announcing the plan.

The $640 billion price tag would be paid for by raising taxes on businesses and financial institutions, including a financial fee on firms with more than $50 billion in assets. Biden said $300 billion of the plan is devoted to new construction.

The $100 billion Affordable Housing Fund would include $65 billion incentives for state housing authorities and the Indian Housing Block Grant program to build or improve “low-cost, efficient, resilient and accessible housing” where affordable housing is scarce. Another $10 billion would be allotted to making homes more energy efficient and $5 billion will be allocated to the HOME program, which helps communities buy property to build affordable housing.

The remaining $20 billion would go to the Housing Trust Fund (paid for by an assessment on Fannie Mae and Freddie Mac) to support the construction and rehabilitation of affordable housing units.

“The housing market continues to be a bright spot in the current economy, which is why it’s critical to support policies and initiatives that ensure its success, while at the same time maintaining a fair and transparent regulatory environment that protects all participants,” Broeksmit said.

Biden also stressed that his plan would “restore the federal government’s power to enforce settlements against discriminatory lenders” – a power the Trump Administration had removed from the Consumer Financial Protection Bureau.

Read Biden’s full housing plan here.