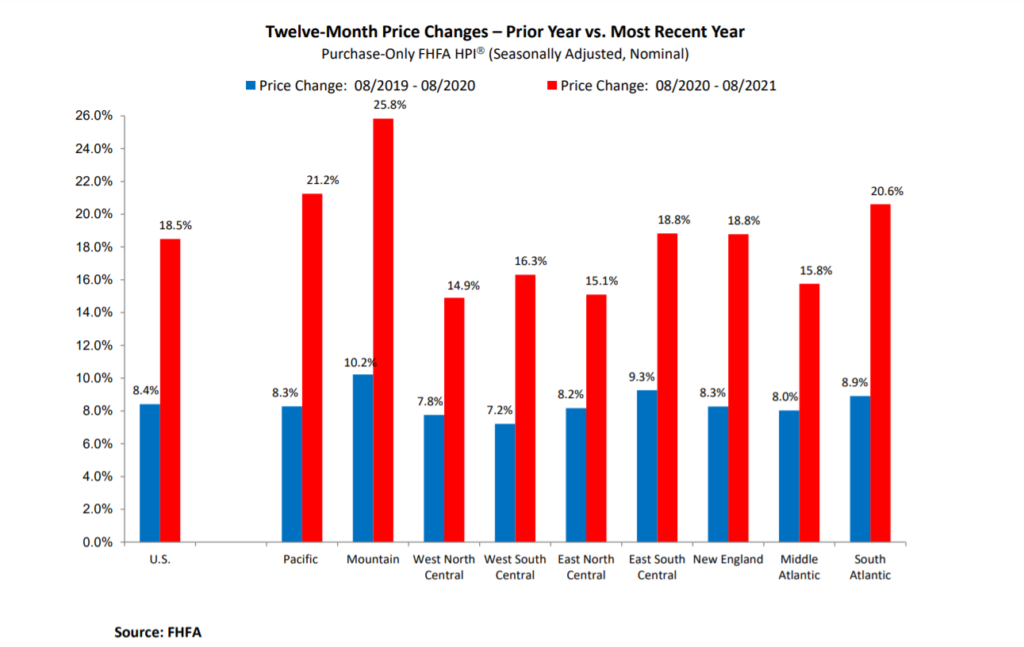

House prices rose 1% in August and are now 18.5% higher than a year ago, according to the Federal Housing Finance Agency’s House Price Index (FHFA HPI).

“Annual house price gains remained extremely high in August but the pace of month-over-month gains continues to decelerate,” said Dr. Lynn Fisher, FHFA’s Deputy Director of the Division of Research and Statistics.

“This does not mean house prices are at risk of declining—far from it, they continue to climb at a double-digit pace in all regions—but it does suggest we may have seen the peak in annual gains for the time being.”

At the same time, First American released its Real House Price Index (RHPI), which showed similar results: Real house prices rose 1.2% between July and August 2021, and 16.6% YOY. Consumer house-buying power rose 0.5% in August 2021, and 3.5% YOY.

The RHPI serves as a measure of housing affordability because it adjusts for house-buying power, taking into account changes in household income, mortgage rates, and nominal house prices.

Real housebuying power is up by these metrics due to higher wages. The report found that median household income rose 2.3% YOY, dampening the negative impact of increasing home prices on affordability. Wage changes over time make real house prices 10.9% less expensive compared to January 2000.

“Rising household income limits the negative impact that higher rates will have on house-buying power,” said Mark Fleming, chief economist at First American. But he also noted that rising mortgage rates will ultimately impact this jump in affordability.

“Average mortgage rates won’t stay as low as they are today forever, and as they rise, the decades-long housing and mortgage market tailwind will turn into a headwind,” he said.

“Rising mortgage rates, all else equal, will diminish house-buying power, meaning it will cost more per month for a borrower to buy ‘their same home.’”

Mortgage rates are trending up, reaching 3.09% last week and topping a recent 6 month high. Freddie Mac cited “inflationary pressure” and tightening monetary policy as primary factors in the increase.