This Halloween, mortgage brokers have more to fear than your typical ghosts and ghouls.

Some economists say the market is rebalancing, while others say the housing slowdown is more severe than a correction.

“Last year, sellers could seemingly list their home at any price and see multiple offers roll in above list price within days,” said Senior Economist Nicole Bachaud of Zillow.

“Now, buyers have some negotiating power, and sellers are under pressure. Buyers are still out there and willing to buy when they find the right home at the right price, which will provide a floor for the price declines we are currently seeing.”

Either way, mortgage brokers are facing a seriously spooky situation: dwindling home sales, decades-high interest rates, and terrified homebuyers who would rather stay in the shadows than have to face unsustainable monthly payments.

Here are some of the scariest numbers in the mortgage business right now:

11,691: By TMN’s estimate, the minimum number of mortgage jobs lost since the beginning of this year

$102: How much monthly payments rose in just one month, from August to September

50: The number of major American cities seeing sharp price declines

10.2%: How far pending home sales slid from August to September

10: The number of consecutive weeks mortgage rates have risen

100%: The chance of a recession in the next 12 months, according to Bloomberg economists

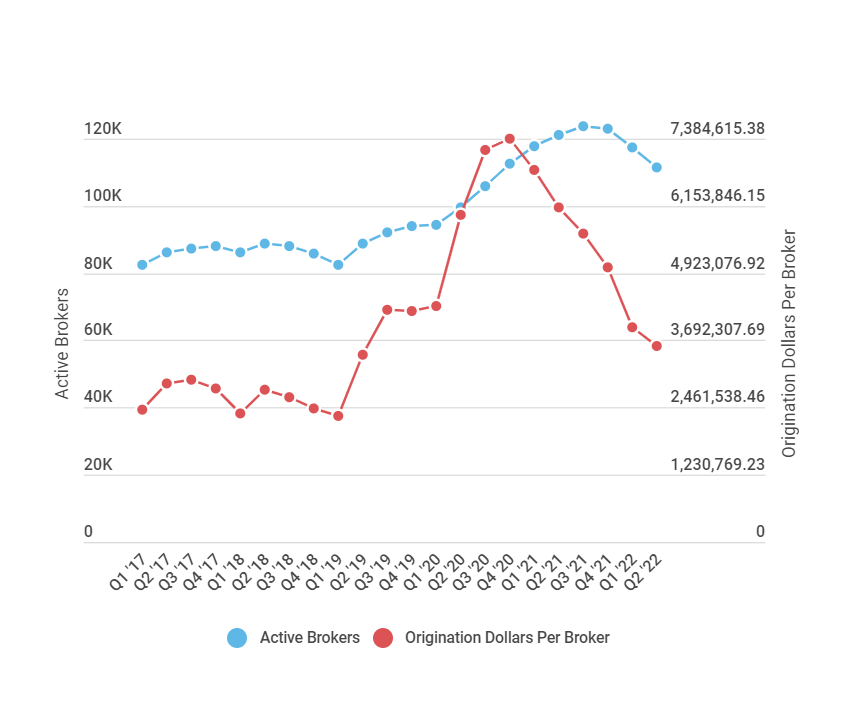

For something truly horrifying, check out this graph showing the difference between the number of active MLOs in the U.S. and originations:

The global chair of The Counselors of Real Estate says inflation and interest rates are this year’s leading concerns of his 1,000-member organization.

At the National Association of Real Estate Editors conference at The Westin Buckhead in Atlanta, GA, William McCarthy said everyone they talk to wants to know about inflation and interest rates. The Counselors of Real Estate is an international consortium of commercial property advisors which has posted a top ten list of issues affecting real estate for 11 years.

“Inflation dictates interest rates. Interest rates dictate inflation,” McCarthy said.

McCarthy said he does not expect to see anything like 2008, when homeowners were upside down in their mortgages, but he did point out that the economic health of modern society is based on consumption.

“The generation before me was, ‘What can I afford?’ The current generation is, ‘What can we make the payments on?’” McCarthy said. “Credit has been very easy as of late and that is something that does concern us because you always wonder, the people in debt themselves, have they used their home like a cash machine?”

Average mortgage rates topped 7% for the first time in 20 years, after hovering just under it for several weeks, Freddie Mac reported Thursday.

Freddie’s Primary Mortgage Market Survey found that the 30-year fixed-rate mortgage averaged 7.08%, up from 6.94% the week prior.

A year ago at this time, the 30-year FRM averaged 3.14%.

Follow Us On Twitter:

Read More Articles:

Sundae Aims To Help As-Is Sellers Connect With Property Investors