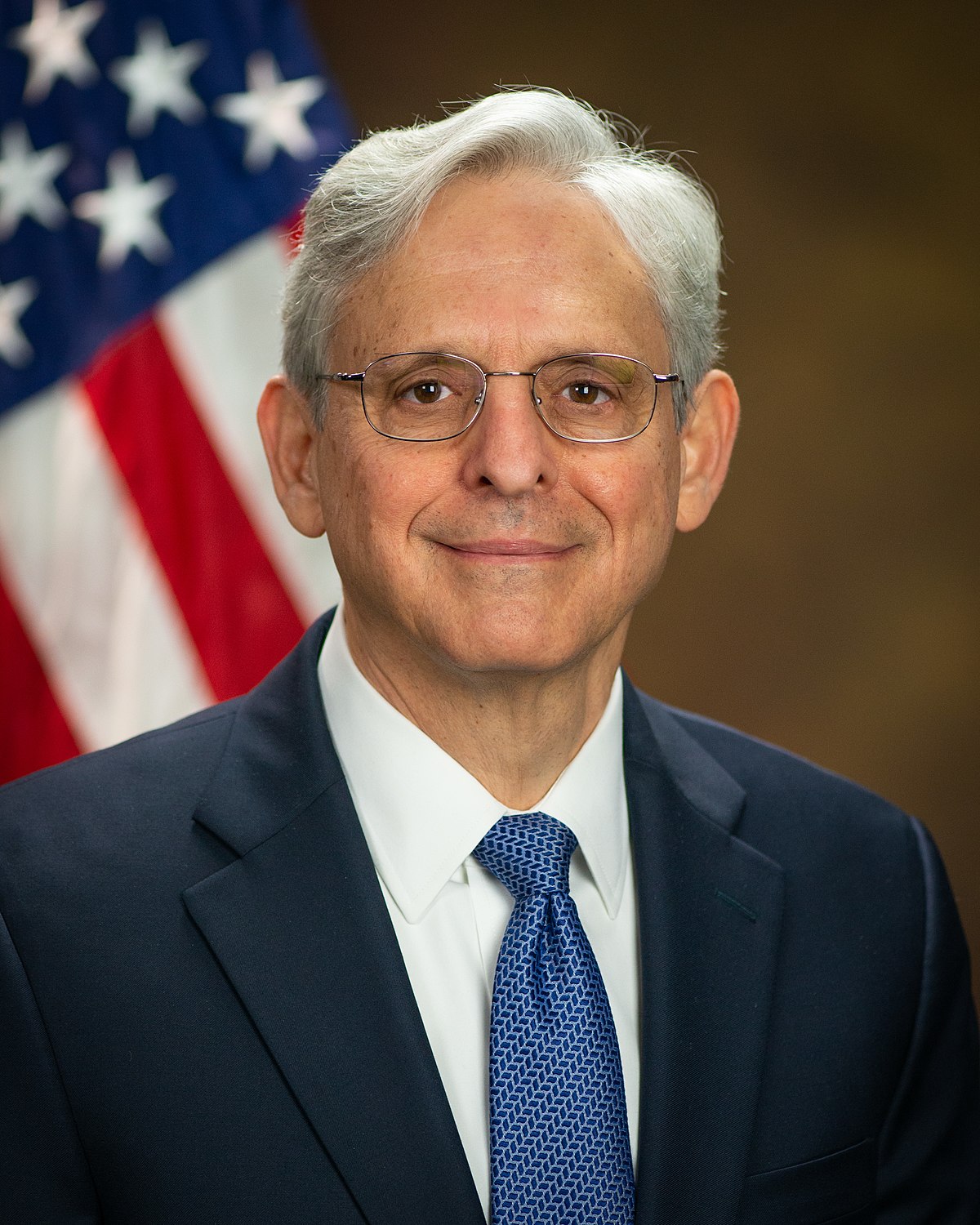

Attorney General Merrick Garland announced a Department of Justice (DOJ) initiative to combat discriminatory redlining policies that make homebuying more difficult for borrowers of color.

In remarks to staff, Garland said the DOJ initiative will target “modern-day redlining.” The DOJ will investigate and prosecute banks with the help of U.S. attorneys around the nation, as well as the Consumer Finance Protection Bureau (CFPB) and the Treasury Department.

“Lending discrimination runs counter to fundamental promises of our economic system,” he said. “When people are denied credit simply because of their race or national origin, their ability to share in our nation’s prosperity is all but eliminated.”

Redlining is a practice of lenders denying loans based on the racial makeup of an area. The name comes from color-coded maps created for homeownership programs during the New Deal. These maps used the color red to denote neighborhoods with Black residents, which were deemed risky investments.

Private lenders eventually began using the same maps to make decisions about loans.

Redlining has led to Black families missing out on at least $212,000 in personal wealth over time, according to Redfin. Garland also noted the disparity between the number of white and Black homeowners had been severely impacted by redlining. White families are 30% more likely to own a home than their Black counterparts, a larger gap than in 1960.

The 1968 Fair Housing Act and the 1977 Community Reinvestment Act banned redlining outright, but some say it continues today in different forms.

“You’re not going to see someone with a map on a wall with red lines around it,” said Stuart Rossman, director of litigation for the National Consumer Law Center. “Although we rarely see redlining, what we do see is a lot of reverse redlining.”

Reverse redlining is a practice in which lenders will offer risky loans to borrowers in redlined neighborhoods, such as the subprime loans that led to the 2008 housing crisis.

Not everyone agrees that racial discrimination in lending is a problem. Housing experts at the American Enterprise Institute have analyzed the data and found lenders are actually “bending over backward” to give applicants in protested racial classes a shot at homeownership.

Garland also announced a successful settlement with Trustmark National Bank in Memphis. The CFPB and Justice Department alleged that between 2014 and 2018, Trustmark discriminated against Black and Hispanic neighborhoods in the Memphis metro area.

Trustmark will pay a $5 million civil penalty, as well as invest $3.85 million in a loan subsidy fund and open a loan office in a majority Black or Hispanic neighborhood in Memphis.

Garland noted that several other investigations are currently open and that more will come “in the months ahead.”

“Our initiative alone will not erase the full legacy of discrimination,” he said. “But we will spare no resource to ensure that federal fair lending laws are rigorously enforced.”