The Federal Finance Housing Agency on Monday announced 2021 housing goals for Fannie Mae and Freddie Mac that are identical to the mortgage purchase goals that were in place for the last three years.

“Due to the economic uncertainty related to the COVID-19 national pandemic, FHFA is proposing benchmarks for calendar year 2021 only, and those levels will remain the same as they were for 2018-2020,” FHFA said in announcing the goals.

Here are the single-family goals for 2021:

| Goal | Current 2018-2020 benchmark | Proposed 2021 benchmark |

| Low-Income Home Purchase Goal | 24 percent | 24 percent |

| Very Low-Income Home Purchase Goal | 6 percent | 6 percent |

| Low-Income Areas Home Purchase Subgoal | 14 percent | 14 percent |

| Low-Income Refinancing Goal | 21 percent | 21 percent |

Here are the multi-family goals for 2021:

| Goal | Current 2018-2020 benchmark | Proposed 2021 benchmark |

| Low-Income Goal | 315,000 units | 315,000 units |

| Very Low-Income Subgoal | 60,000 units | 60,000 units |

| Low-Income Small Multifamily Subgoal | 10,000 units | 10,000 units |

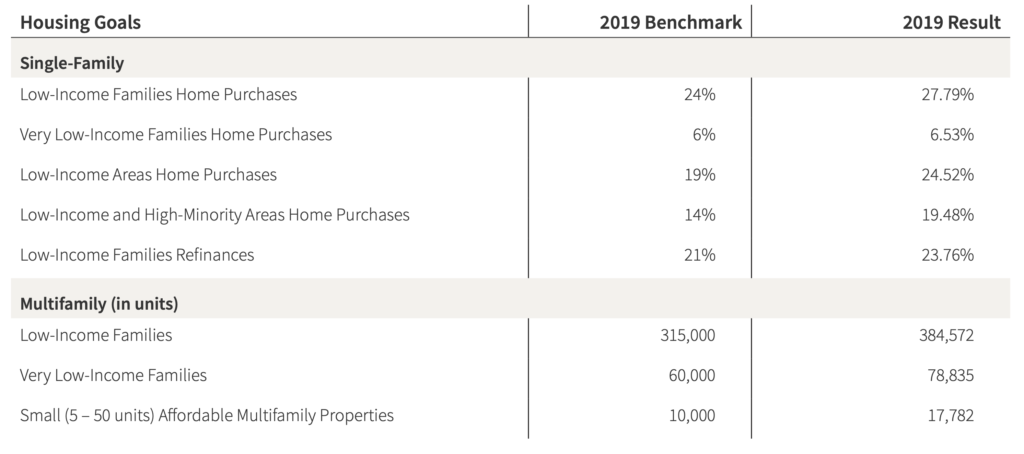

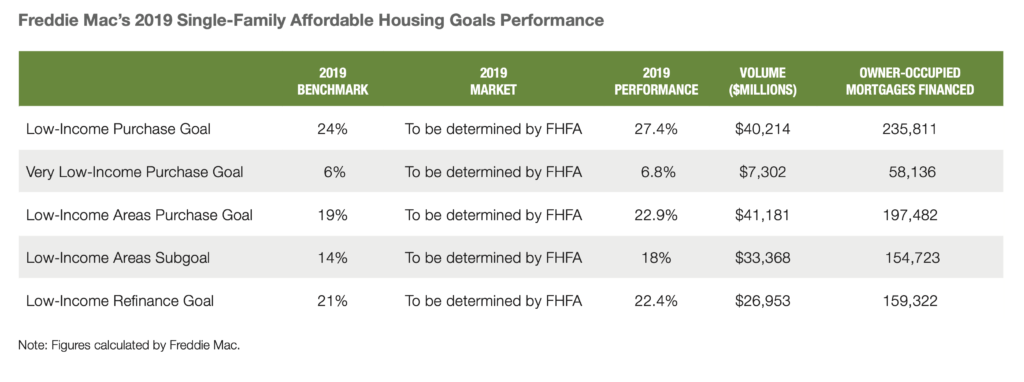

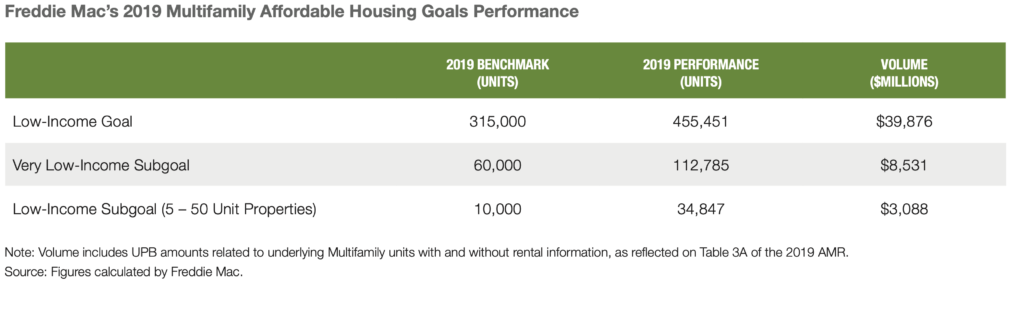

Earlier this year, Fannie Mae and Freddie Mac announced they met and exceeded all goals for 2019, as shown in the following charts, meaning the goals for 2021 are in some cases far below what they achieved in 2019. The numbers for 2020 – which will undoubtedly be impacted by the coronavirus pandemic – will be released next year.

Here are Fannie’s results:

Here are Freddie’s results:

See Fannie and Freddie’s full year reports for 2019 here and here.