The FHFA’s Q2 House Price Index (HPI) saw its largest ever annual gain, with house prices rising 17.4% year-over-year, up from 12.6% in the last quarter. This surge in home prices breaks the previous record, set in Q1.

The FHFA HPI measures the movement of single-family house prices by reviewing repeat mortgage transactions on homes whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac since January 1975.

“During the second quarter, house prices peaked in June with an 18.8 percent growth rate compared to a year ago,” said Dr. Lynn Fisher, Deputy Director of FHFA’s Division of Research and Statistics. “For the quarter, annual gains surpassed 20 percent in the Mountain, New England, and Pacific census divisions and in all of the top 20 metro areas.”

The seasonally adjusted monthly index for June increased 1.6 percent from the previous month.

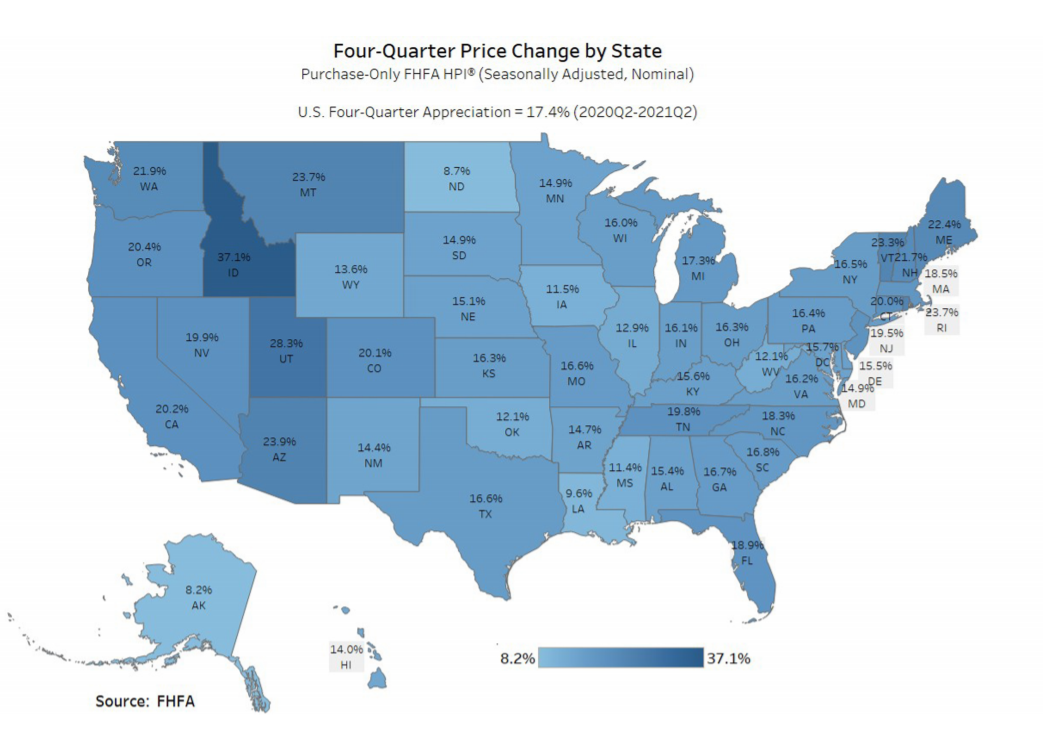

Prices rose in every state and the District of Columbia year-over-year, with the greatest gains in Idaho (up 37.1%), Utah (28.3%), Arizona (23.9%), Montana (23.7%), and Rhode Island (23.7%).

The states with the smallest gains were Alaska (8.2%) and North Dakota (8.7%).

FHFA’s report coincides with year-over-year data from the S&P CoreLogic Case-Shiller Indices, which are calculated monthly. Case-Shiller reported a 18.6% annual gain in June, up from 16.8% in May.

“We have previously suggested that the strength in the U.S. housing market is being driven in part by reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “June’s data are consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years.

“Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question. As has been the case for the last several months, prices were strongest in the Southwest (+22.7 percent) and West (+22.6 percent), but every region logged top-decile, double-digit gains.”