As the Covid-19 pandemic continues to hammer away in the United States, the Federal Housing Administration announced Monday that it is extending the foreclosure and eviction moratorium for FHA-insured mortgages through February 28.

The FHA also is extending the deadline for single-family borrowers with FHA-insured mortgages to request forbearance from their lender. Forbearance allows homeowners to defer or reduce mortgage payments for up to six months, along with a possible six-month extension.

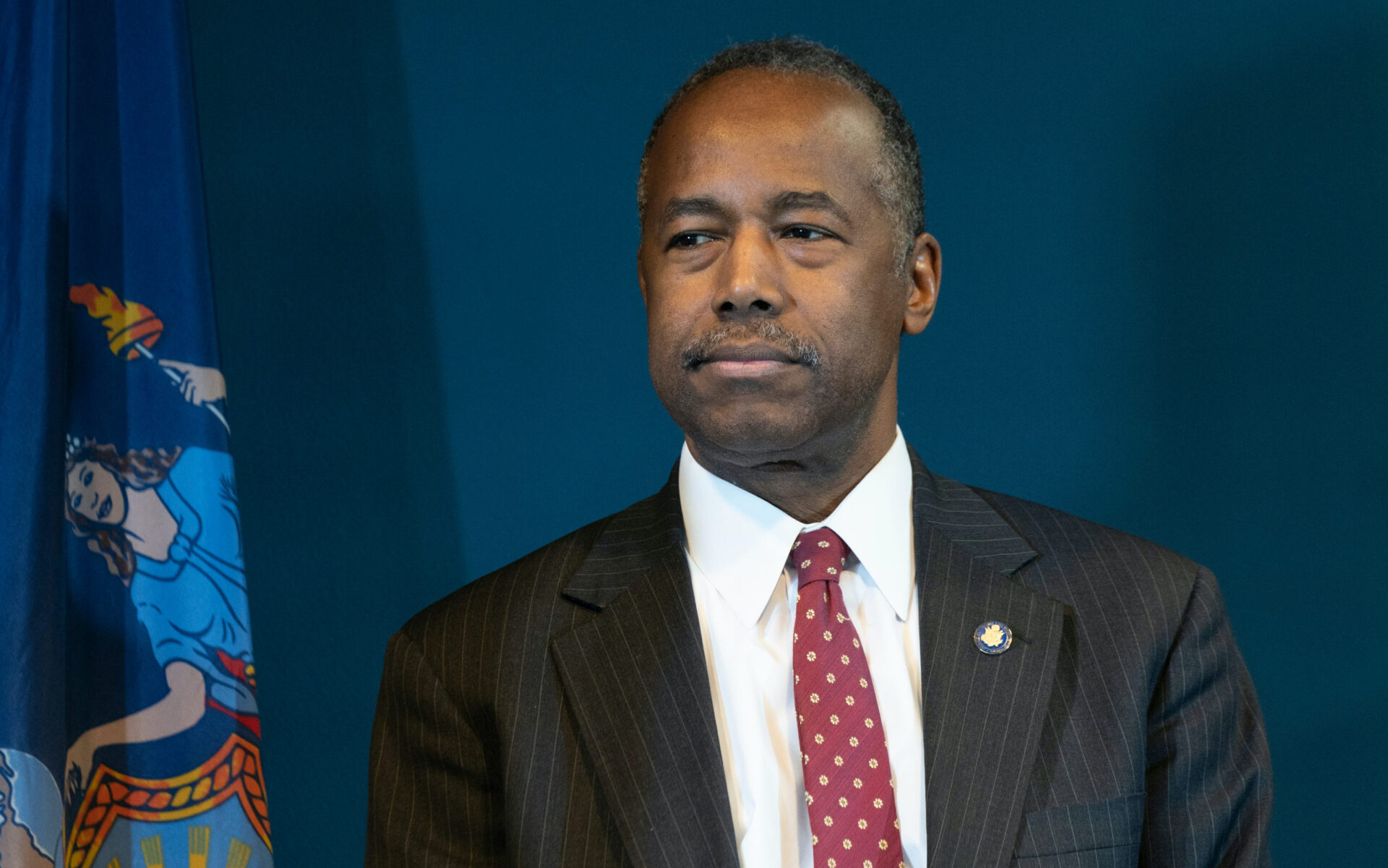

“Today’s foreclosure moratorium and forbearance extensions for single family homeowners ensure American homeowners continue to have the critical relief and support they need to get back to financial stability,” HUD Secretary Ben Carson said.

This is the fourth extension of FHA’s eviction and foreclosure moratorium, which bars servicers from initiating or proceeding with foreclosure and foreclosure-related eviction actions for FHA-insured single family forward and reverse mortgages, except for those secured by legally vacant and abandoned properties.

“COVID-19 has created hardships for millions of Americans,” Assistant Secretary for Housing and Federal Housing Commissioner Dana Wade said. “FHA will continue to assist borrowers who are struggling to regain their financial footing as a result of this pandemic. American homeowners should not be forced from their homes while they are seeking help.”