The federal government on Wednesday ordered a 60-day moratorium on foreclosures and evictions for single-family homeowners with Federal Housing Administration, Fannie Mae and Freddie Mac-backed mortgages amid the coronavirus pandemic.

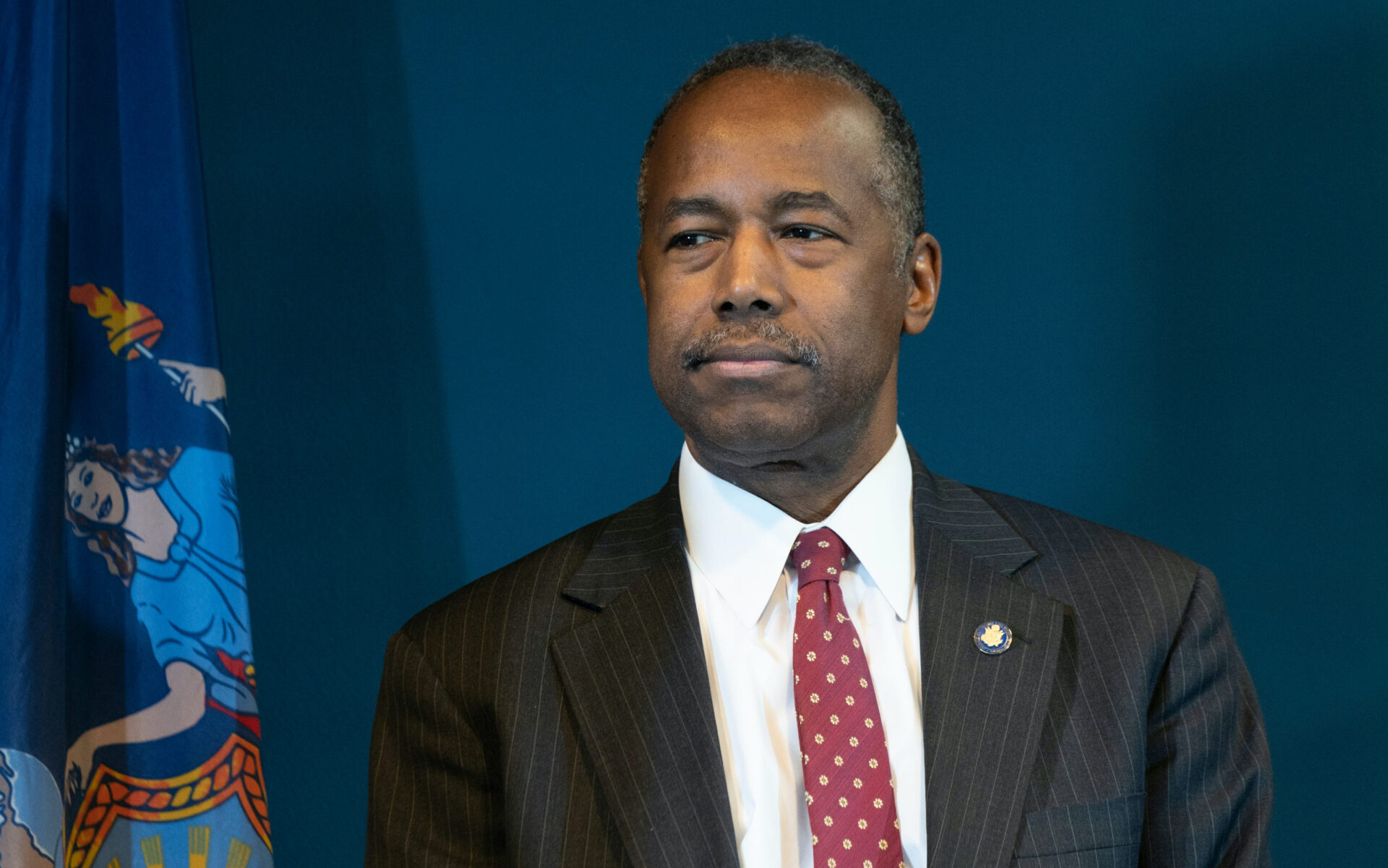

U.S. Department of Housing and Urban Development Secretary Ben Carson announced the moratorium for FHA loans, which directs mortgage companies to:

- Halt all new foreclosure actions and suspend all foreclosure actions currently in process; and

- Cease all evictions of persons from FHA-insured single-family properties.

The Federal Housing Finance Agency also directed Fannie Mae and Freddie Mac to suspend foreclosures and evictions for at least 60 days due to the coronavirus. FHFA also announced earlier this month that Fannie and Freddie would provide “payment forbearance” to borrowers impacted by the coronavirus. Forbearance allows for a mortgage payment to be suspended for up to 12 months due to hardship caused by the coronavirus.

“Today’s actions will allow households who have an FHA-insured mortgage to meet the challenges of COVID-19 without fear of losing their homes, and help steady market concerns,” Carson said. “The health and safety of the American people is of the utmost importance to the Department, and the halting of all foreclosure actions and evictions for the next 60 days will provide homeowners with some peace of mind during these trying times.”

There are roughly 8.1 million FHA loans, making up roughly 17 percent of the market.

The moratorium applies to homeowners with FHA-insured Title II Single Family forward and Home Equity Conversion (reverse) mortgages.

“This is an uncertain time for many Americans, particularly those who could experience a loss of income. As such, we want to provide FHA borrower households with some immediate relief given the current circumstances,” said Federal Housing Commissioner Brian Montgomery. “Our actions today make it clear where the priority needs to be.”

The Mortgage Bankers Association did not immediately issue a statement or respond to an email requesting comment about the moratorium. On Tuesday, the organization commended government leaders for “helping both consumers and businesses during this difficult time.”

The industry can be most helpful to many homeowners by more efficiently refinancing their mortgages, thereby reducing their monthly payments,” MBA said in a statement. “This can be an important component of the economic stimulus, and we are working to remove hurdles that could impede that.”

MBA said the industry is also focused on streamlining policies and procedures that will allow lenders to help borrowers experiencing hardships during the pandemic.