A federal court on Wednesday tossed the Centers for Disease Control and Prevention’s ban on evicting tenants who do not pay their rent during the Covid-19 pandemic, saying the health agency lacks the authority to issue such a moratorium. The U.S. Department of Justice announced it would appeal the decision.

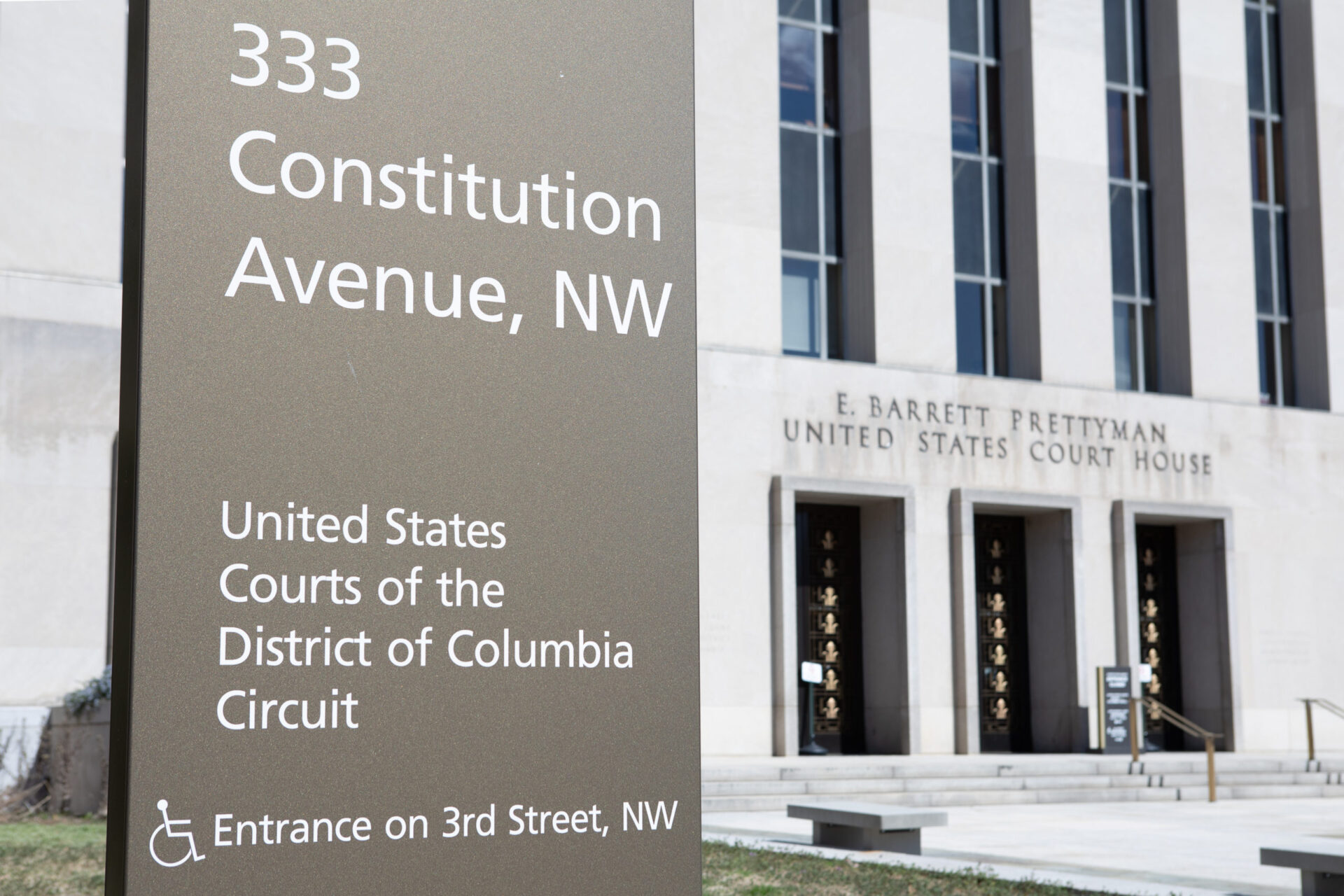

In a suit filed by the Alabama and Georgia Associations of Realtors and others, the U.S. District Court for the District of Columbia found that “the plain language of the Public Health Service Act … unambiguously forecloses the nationwide eviction moratorium.”

“The Court recognizes that the COVID-19 pandemic is a serious public health crisis that has presented unprecedented challenges for public health officials and the nation as a whole,” Judge Dabney J. Friedrich wrote in his ruling. “The pandemic has triggered difficult policy decisions that have had enormous real-world consequences. The nationwide eviction moratorium is one such decision.”

The Justice Department disagreed and will appeal.

“The Department of Justice respectfully disagrees with today’s decision of the district court in Alabama Association of Realtors v. HHS concluding that the moratorium exceeds CDC’s statutory authority to protect public health,” Brian M. Boynton, Acting Assistant Attorney General for the Justice Department’s Civil Division, said. “In the department’s view, that decision conflicts with the text of the statute, Congress’s ratification of the moratorium, and the rulings of other courts.”

The CDC issued the public health order in September under President Trump that banned residential evictions to prevent the spread of Covid-19. The CDC order, issued under the Public Health Service Act, covered renters of apartments or residential properties – but did not include a ban on foreclosures on home mortgages. It required renters to certify to landlords that they would become homeless or forced to live with others “in close quarters” if they were to be evicted.

Just this week, the federal government sent letters to the nation’s largest apartment landlords warning them to honor federal rules preventing renters from being evicted for non-payment of rent during the pandemic.

The Consumer Financial Protection Bureau and Federal Trade Commission reminded landlords that the temporary moratorium on evictions is in place through the end of June.

How big of an issue are missed payments?

The Mortgage Bankers Association reported Wednesday that 7.7 percent of renters (or 2.56 million) renters missed payments in March, down from about 7.9 percent in March.

MBA said 76.3 percent of renters made all their rental payments over the last 12 months, while 10.7 percent missed one payment, 4.4 percent missed two payments, 2.5 percent missed three payments, and 6.1 percent missed four or more payments.

“The rapidly improving economy and labor market, increased vaccination rates, and promising trend of declining COVID-19 cases all bode well for those who are still facing unemployment or underemployment because of the pandemic,” said Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University. “However, millions of families are still facing economic distress, despite improving conditions since last March.”

The National Association of Realtors supported the lawsuit against the CDC, saying the ban was no longer needed.

“NAR has always maintained that the best solution for all parties was rental assistance to cover the rent, taxes and utility bills for tenants struggling during the pandemic,” NAR President Charlie Oppler said. “This decision prevents two crises—one for tenants, and one for mom-and-pop housing providers who do not have a reprieve from their bills. With rental assistance secured, the economy growing, and unemployment rates falling, there is no need to continue a blanket, nationwide eviction ban. With this safety net firmly in place, the market needs a return to normalcy and stability.”