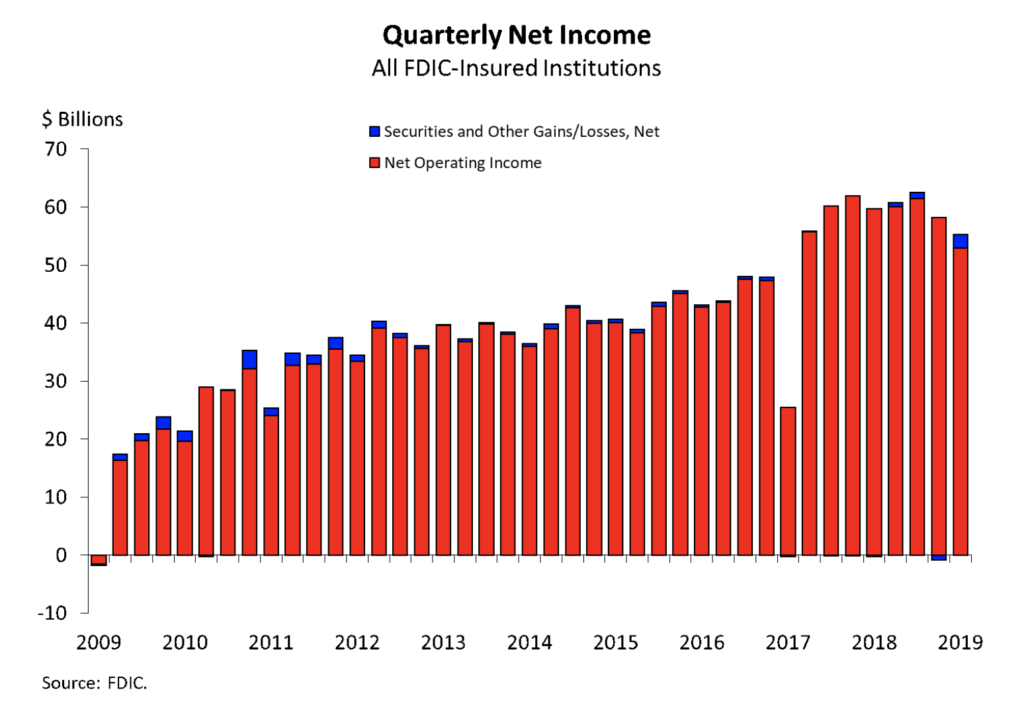

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation reported net income totaling $55.2 billion in the fourth quarter of 2019, according to the FDIC’s Quarterly Banking Profile released Tuesday. That is a net income decline of $4.1 billion (or 6.9 percent) from the fourth quarter of 2018, driven mostly by lower interest income and higher expenses.

Full year profits declined 1.5 percent to $233.1 billion for the 5,517 banks insured by the FDIC.

“The banking industry remains strong, despite declines in full-year and quarterly net income,” FDIC Chairman Jelena McWilliams said. “Loan balances continue to rise, asset quality indicators are stable, and the number of ‘problem banks’ remains low. Community banks reported another positive quarter. Net income at community banks improved because of higher net operating revenue, and the annual loan growth rate at community banks exceeded the overall industry.”

Other highlights include:

- Net interest margin declined from a year ago by 20 basis points to 3.28 percent, while net interest income fell by $3.4 billion – the first annual decline since the third quarter of 2013.

- Total loan and lease balances increased by $99.5 billion (1 percent) from the previous quarter, led by consumer loans – including credit cards (up 1.5 percent) and residential mortgage loans (1 percent). Over the last year, total loan and lease balances rose by 4.6 percent.

- The quarterly net income for the 4,750 FDIC-insured community banks was 4.4 percent higher than a year ago.

“During the second half of 2019, we saw three reductions in short-term interest rates and yield-curve inversions,” McWilliams said. “These factors present challenges for banks’ credit extension and funding. It is vital that banks maintain careful underwriting standards and prudent risk management in order to maintain lending through economic fluctuations.”