The overall mortgage delinquency rate fell to a record low in March, according to new data from CoreLogic.

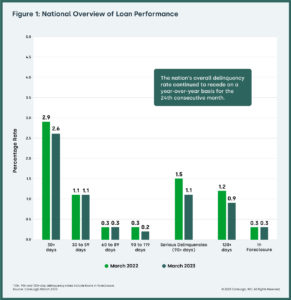

Just 2.6% of all mortgages in the U.S. were in some stage of delinquency, down 0.3% from March 2022 and 0.4% from the month prior.

This is the lowest level ever recorded. CoreLogic chalks it up to the country’s unemployment rate, which is at a 50-year low.

Serious delinquencies in particular benefitted, down 1.5% YOY to 1.1% of all mortgages, a 23-year low.

Early-stage delinquencies (1.1%) and adverse delinquencies (0.3%) were unchanged YOY. The share of mortgages in some stage of foreclosure (0.3%) and the share that transitioned from current to early-stage (0.5%) were also unchanged from the same time last year.

Economic uncertainty has caused fear that many Americans could lose their homes in the coming year. But Molly Boesel, principal economist for CoreLogic, finds it unlikely.

“While a slowing economy could cause increases in job losses and mortgage delinquencies, years of home equity gains will provide borrowers who fall behind on their payments with a cushion,” Boesel said.

“This equity should protect many homeowners from foreclosures. There is no current projection that the U.S. foreclosure rate will reach the same level as it did during the housing crisis more than a decade ago.”

Though the number of equity-rich homes fell in Q1 2023, equity remains historically high. Around 93% of borrowers in foreclosure have equity in their homes, which can help protect them from serious financial damage through sale or a loss mitigation plan.

“This is a complete reversal from where things stood in 2008, when 30% of all homeowners—and virtually everyone in foreclosure—were upside down on their loans,” Rick Sharga, executive vice president of market research for ATTOM Data Solutions, said.

Read More Articles:

Learn More About The Construction Lending Market With CEO Brian Mingham