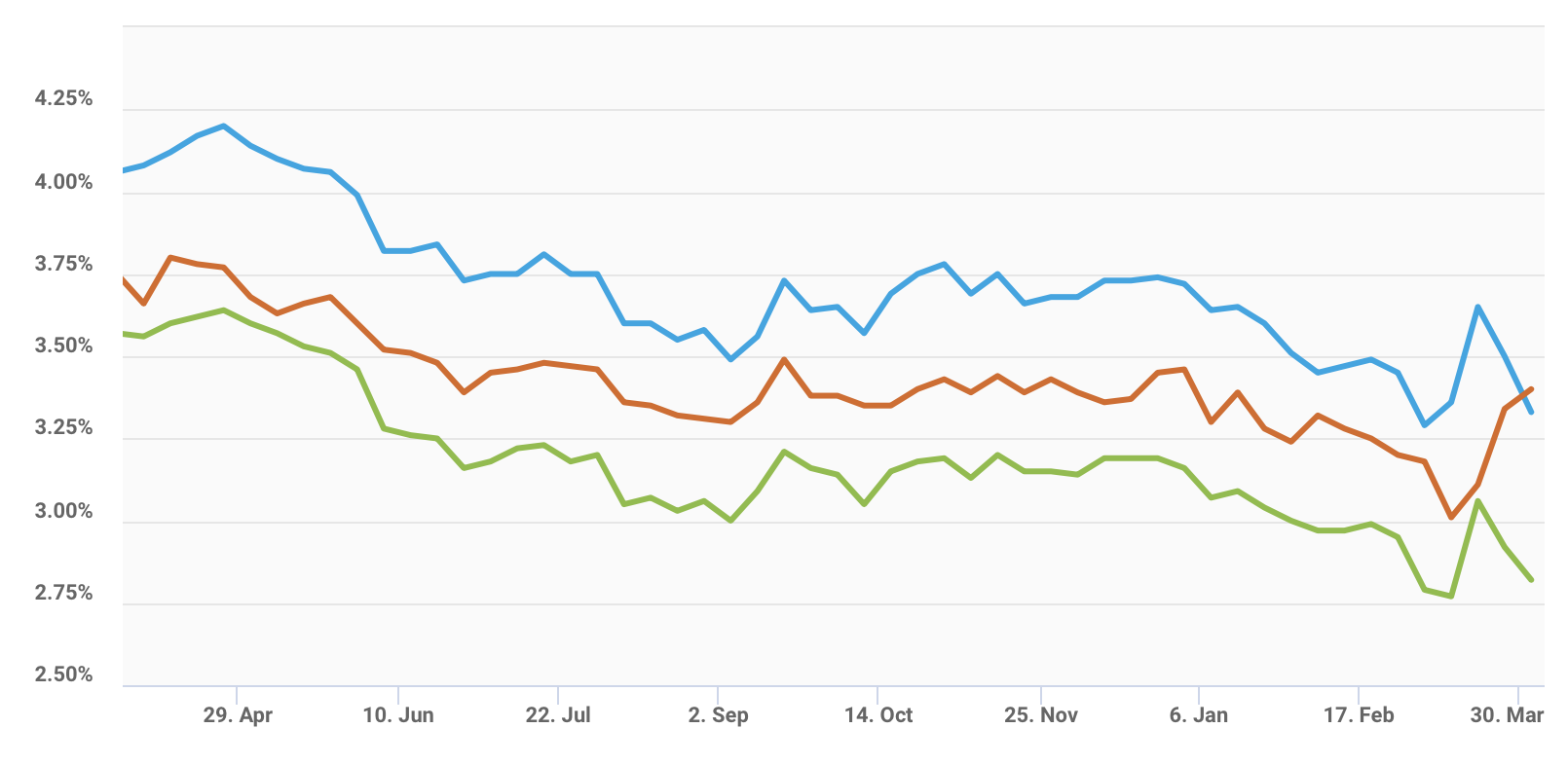

Mortgage rates dropped for the second week in a row – and almost reached the nearly historic lows from before the coronavirus fully hit the United States. The 30-year fixed-rate mortgage averaged 3.33 percent in Freddie Mac’s Primary Mortgage Market Survey released Thursday.

“Mortgage rates have drifted down for two weeks in a row and that drop reflects improvements in market liquidity and sentiment,” Freddie Mac Chief Economist Sam Khater said. “While the market has stabilized relative to prior weeks, homebuyer demand has declined in response to current economic conditions. The good news is that the pending economic stimulus is on the way and will provide support for both consumers and businesses.”

Mortgage rates hit a low of 3.29 percent for the week ending March 9, the last week before concerns about the coronavirus pandemic took hold.

This week’s mortgage report found:

- 30-year fixed-rate mortgage averaged 3.33 percent with an average 0.7 point for the week ending April 2, down from last week’s 3.50 percent and 4.08 percent a year ago.

- 15-year fixed-rate mortgage averaged 2.82 percent with an average 0.6 point, down from last week when it averaged 2.92 percent and 3.56 percent a year ago.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.40 percent with an average 0.3 point, up from last week’s 3.34 percent and 3.66 percent a year ago.

Mortgage applications increased 15.3 percent in the United States last week, according to the Mortgage Bankers Association weekly survey released Wednesday. That number was tempered by significant drops in coronavirus hotspots such as California (down 16.5 percent and 36.4 percent from last year) and New York (down 18.1 percent for the week and 35.6 percent from last year).